Shared Space with Live Portfolio Tools Launch

First release: Portfolio Dashboard. Next: Watchlist, Earnings Commentary and Research Library

Big Announcement

I’m excited to announce the launch of a shared space featuring analytical tools that will enable subscribers to monitor live changes to my portfolio and market view in general.

This will be a shared folder with a set of documents, updated in real time as I make changes.

The first release is today:

Portfolio Dashboard

It includes two key parts:

1. Portfolio Breakdown

Trades by ticker, linked to long/short side, sector, option structure expiration month, and sizing

Valuation structure: long/short split, sector allocation, total amount allocated, and portfolio analytics

2. Option Trades Structures

Full list of all trades initiated and currently in the portfolio

Breakdown of trades by structure type: Single-leg Call/Put, Calendar spreads, or Verticals

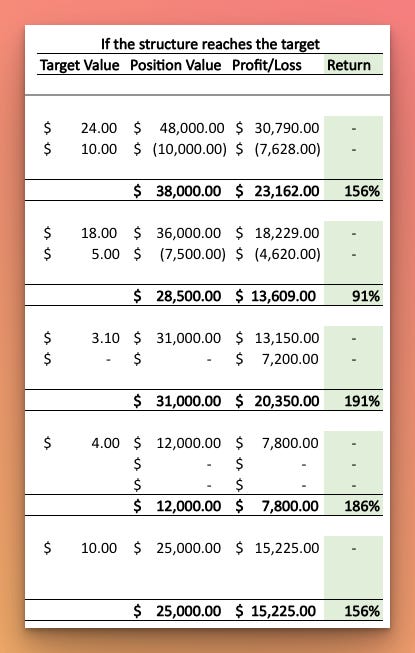

Return calculations: premium paid vs. target option value if the underlying stock reaches my target price

Risk calculations

These two spreadsheets are the core of my daily operations — and now you’ll have direct access to them.

The biggest value: all data updates automatically whenever I make a change to my portfolio.

More tools will be added soon:

Ideas Watchlist

Corporate Earnings Commentary

Research Library

📌 I will post a link to the shared space in the chat, and it will also be delivered to you by email once you activate the paid subscription.

Why subscribe?

We are about to enter Q3 Earnings Season, and much volatility is guaranteed in the market. Options are the only derivative instrument that allows you to benefit from a high-volatility environment.

Options are quite sophisticated and require significant time and effort to operate confidently. There won’t be a quick win. At the same time, the way I present the information allows readers to enter the topic effectively.

Good pricing for great value. To access this quality, most would need to pay much more in both price and time to reach the desired expertise. Since I share information with practice, understanding the process becomes much faster.

Uncrowded ideas that deliver. Last week, I shared 4 hot stock ideas to crush Q4 with 200%+ options return potential, and as of today, one of them, which was mentioned as being in my portfolio, has risen by 60%. The value of the option structures increased by much more.