4 Hot Stock Ideas to Crush Q4 with 200%+ Options Return Potential

Inside my YTD 100%+ return strategy: the trades, catalysts, and my current positioning

Greetings to new subscribers

I got a bunch of new subscribers this week. Thank you for deciding to subscribe to my newsletter. Special thanks to our paid subscribers - I’m sure this will be a valuable investment in your learning about the markets.

Who is this project for?

Fundamental active investors and traders who would like to enhance their investing process by using option strategies.

Passive investors who are seeking new solutions to enrich or hedge their portfolios.

Financial market enthusiasts who are about to learn something new and get their place in the market.

I am fairly certain that permanent and consistent readers will level up their understanding of the stock market, a process that involves picking stocks for their portfolios and building option structures to complement their trades.

Subscription plans

Free subscribers: access to occasional posts, paid posts preview, 1-time post unlock, and 7-day free trial.

Paid subscribers: full access to all content published here, Substack chat, and analytical tools like the research library, corporate earnings bank, watchlist, and option structures I currently have in my portfolio.

Content Sections

The Options Playbook: Market and Corporate Earnings Commentary, Specific Company Analysis, Piece of Knowledge.

Portfolio Performance: Monthly Portfolio Performance Update, New Trades Initiating, Risk Management, and Situational Commentary.

The sections are about to be modified soon.

With the introductory section complete, we can move on to the main content.

Market View

Remember, we are in the bull market regime. A cooling labor market could be a concern for the market these days, but not a trigger to reevaluate the recession risks and nor a time for any sort of sell-off.

What can be more real is a pullback and then further going higher.

In case of rapid economic deterioration, I have my short side of a portfolio with fundamentally weak companies.

Corporate Earnings

When you’d like to validate your portfolio position, always refer to the 1-year forward companies’ revenue and earnings projection. This is somewhat what the market anticipates from the corporate world and prices today.

There are 3 ways to do that:

Look at the bank analysts’ consensus considering the revision side - whether they increase or decrease it. They usually make it for each particular public company and then pull it up to the whole market.

Read the earnings call transcripts of the leading companies in each industry you could be interested in. The management often gives its guidance for the upcoming quarter and year.

Look at the leading macroeconomic data that could give you a sense of how this or that industry could be affected by the macro environment.

This is what I usually do on my side when picking the stocks for my portfolio. This is a foundational work.

There are a few recent quarterly earnings results that I found useful to shed light on a particular industry and generate ideas for the Q3 calendar year earnings season.

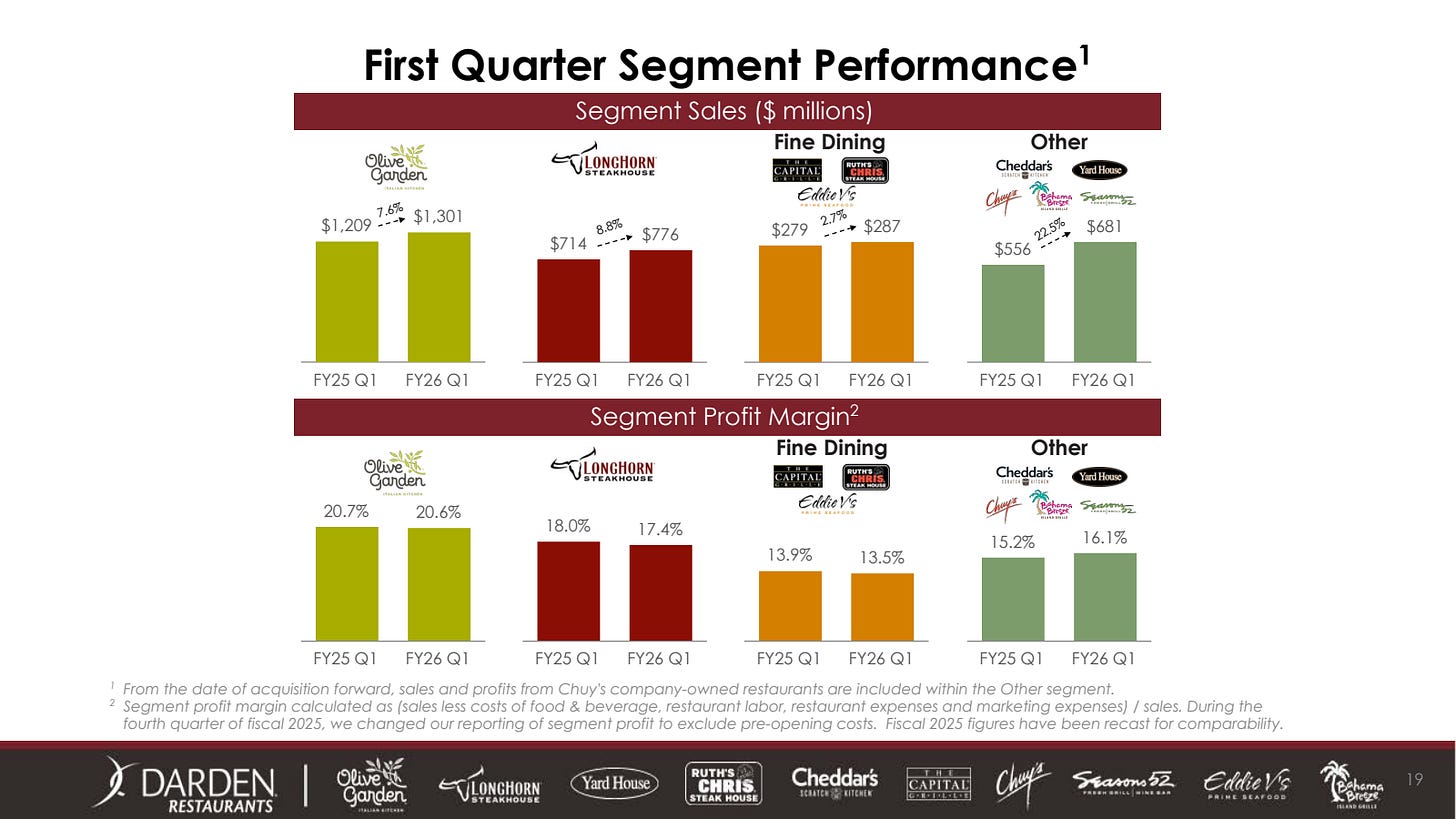

Darden Restaurants DRI 0.00%↑ #neutral

Sector: Consumer Discretionary

Industry: Restaurants

Report period: Jun-Aug’25, FY Q1’26

The company is focused on the Casual Dining segment and, to a lesser extent, on Fine Dining, which is down.

3 cents miss on EPS catalyzed the stock devaluation, mostly based on cooling down the sales and EPS growth, and more sensitive to cost increase - the company raised the sales outlook but remained the same on the EPS bar.

The crucial thing is similar to what is happening to SFM 0.00%↑ - decreasing uptick in same-store sales dynamics.

Restaurant-level profit margin got lower over the course.

I’m not a buyer here. This industry is heavily dependent on consumers' spending dynamics and fierce competition.

AutoZone AZO 0.00%↑ #neutral

Sector: Consumer Discretionary

Industry: Specialty Retail (Automotive)

Report period: Jun-Aug’25, FY Q4’25

Showed slowing same-store sales growth, with sales and EPS coming in below consensus. EPS growth for this year has been revised to around 0%.

A weak consumer is a tailwind here, as more drivers repair cars rather than buy new ones. However, expectations of lower credit rates may shift sentiment toward higher new-car purchases, a potential headwind for AutoZone.

I would monitor this company as more evidence about the industry appears.

Micron Technology MU 0.00%↑ #long

Sector: Information Technology

Industry: Semiconductors

Report period: Jun-Aug’25, FY Q4’25

The thing I liked is that the recent quarter results showed their acceleration, which could be a solid foundation to revise up the next year’s results projection.

Fiscal Q4 2025 delivered record revenue, gross margin, and EPS, all above the high end of guidance, driven by strong pricing, broad-based end market performance, and AI data center growth.

DRAM revenue segment is a tailwind with HBM products for AI implications, leading the trend.

Margins were up across the board. Fiscal Q4 2025 consolidated gross margin was 45.7%; operating margin was 35%; net margin was 31%.

Gross margin guided for Q1 2026 turned even higher - 51.5%.

The company increased its CAPEX plans.

Customer inventory levels were healthy; supply growth for non-HBM DRAM and NAND was below industry demand.

I shortlisted them as a potential Long if I need one for my book in the near term.

CarMax KMX 0.00%↑ #short

Sector: Consumer Discretionary

Industry: Specialty Retail (Automotive)

Report period: Jun-Aug’25, FY Q2’26

Before earnings, I saw the company as a potential long since they delivered better than expected FY Q1’26 earnings results.

In addition, I looked at data from the COX Automotive portal and saw a continuation of upward sales in the used cars market during the summer period. That made me confident in pulling the trigger and putting a 1/4 long position in my portfolio.

But that wasn’t the case - the company reported weaker than expected results both in Revenue and EPS.

Industry in general performed well during the period. That makes me think that the effect is purely company-related. All eyes are on the future CVNA 0.00%↑ and AN 0.00%↑ earnings results.

Accenture ACN 0.00%↑ #long

Sector: Information Technology

Industry: IT Services

Report period: Jun-Aug’25, FY Q4’25

The company reported quarterly results better than expected but guided lower sales in the next FY.

In 2026 FY the half of the revenue growth will be supported by M&A activities - that can be a concern for the market.

The company bet on the cybersecurity services niche, where it sees a significant potential for growth.

Margins are fine at the moment. The US business is weak, especially in its Federal segment. The AI revenue segment is growing, but still takes only ~15% of Revenue.

I see here the near-term long as the shares look oversold on fear of disruption by Gen AI products in the consulting field. It seems too early to come to such conclusions.

Costco Wholesale COST 0.00%↑ #long

Sector: Consumer Staples

Industry: Distribution and Retail

Report period: Jun-Aug’25, FY Q2’26

Strong report - results are in line with consensus, guidance kept strong.

Market reaction could be based on a slight miss on comparable sales and a decline in membership renewals, which was explained as a shift to more e-commerce sign-ups.

Both factors are too minor to justify any significant sell-off.

I would be a buyer here, especially for a longer term. But the stock’s volatility is not high enough to initiate an option structure.

👉 Inside the paywall:

Crushing Trade Ideas: 4 stocks with 200%+ potential return using option structures

Portfolio Update: How my portfolio shifted this week

📊 YTD, this strategy is up +102.5% on capital - and these are the actual trades driving that performance.

📩 Upgrade to a paid plan to unlock the full breakdown + access to the private chat.