Options trading for beginners: call option purchase

a simple step-by-step guide using a real trade example

Do you want to profit from options, but your first contract feels intimidating?

You open the options chain…

And suddenly you’re staring at strikes, expirations, bids, asks, Greeks, and numbers everywhere.

Most beginners don’t lose money with options because options are dangerous.

They lose money because no one shows them how to structure the trade.

That’s what this guide is for.

Why now is the best time to learn it?

Right now, we’re in the most opportunity-rich environment for options traders:

Earnings season = Options Gold Rush

Over the next 6 weeks, price swings will be larger than normal. That’s exactly when options become powerful tools.

They give you a defined risk with asymmetric upside.

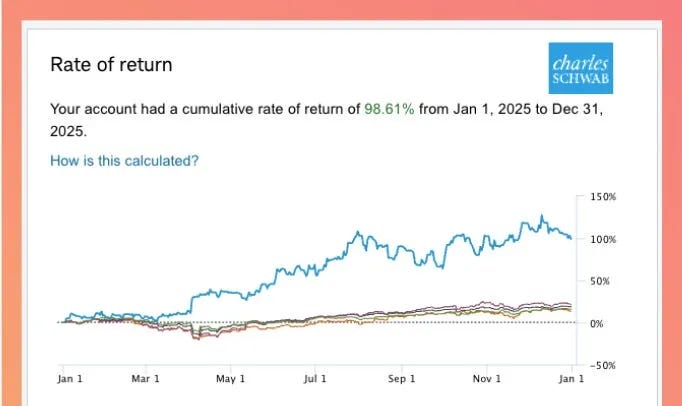

This is how in 2025, I earned $173,798 with options, or a 98% account growth.

Today, I’ll walk you through exactly how to buy a call option, step-by-step, using a real example.

The example we’ll use: Vertiv ($VRT)

I’m bullish on Vertiv and outlined the full trade thesis here:

Instead of buying shares outright, I prefer structuring trades with call options.

This post will show you:

What you’re actually buying

How pricing works

How to avoid common beginner mistakes

How one option can outperform stock ownership

First: the basics you must understand

Before we dive into the numbers, let’s look at the basics.

1. All options expire

Unlike stocks, options do not last forever.

Every option has an expiration date. After that date, the contract no longer exists.

This is why timeframe selection matters.

You are not just betting on direction, you are betting on direction + time.

2. All options have a “strike price”

The strike price is the price at which you can buy (or sell) shares of the stock.

Example:

If you own a $200 call, you have the right to buy 100 shares at $200, even if the stock is trading far above that price later. Imagine the stock trading at $250 and that you can buy it at $200. That’s a $50 profit per share.

3. All options have an option contract multiplier

This is where beginners get tripped up.

If a stock trades at $120:

Buying 1 share costs $120

If an option trades at $5.00:

You are not paying $5

You are paying $5 × 100 shares = $500

Because options can be used to trade 100 shares of stock. We need to multiply the price of the option by 100 to get its actual value or “premium.”

Why I use call options instead of buying stock

As I outlined in my article here, I’m quite bullish on Vertiv.

Read the trade idea here:

If I’m bullish on a stock, I have two choices:

Buy shares

Buy a call option

I almost always choose call options, because they allow me to:

Risk less capital

Control more upside

Define downside upfront

What is a call option?

A Call option gives you the right to buy a stock at a specific price within a certain timeframe.

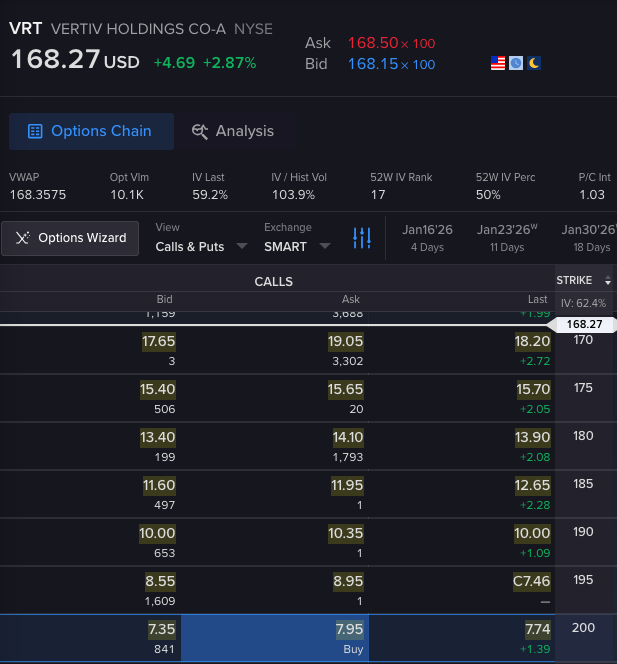

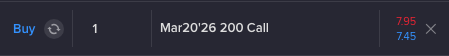

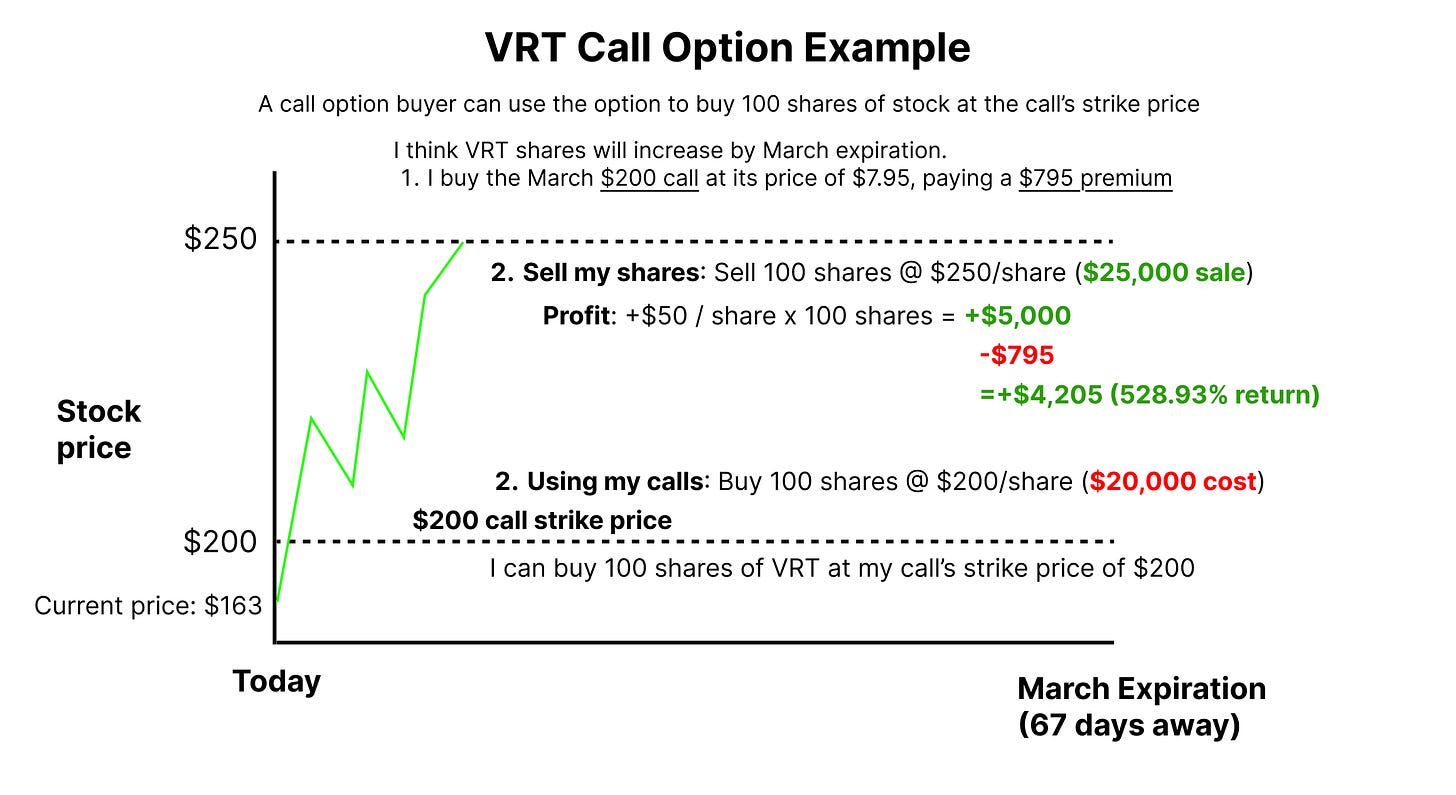

For the $VRT option contract I’m looking at:

Strike price: $200

Expiration: March 20, 2026

Contract price: $7.95

That means:

I control 100 shares of VRT

I can buy them for $200 each

Even if the stock trades much higher later

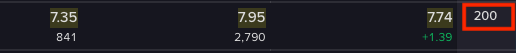

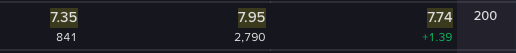

The highlighted number above is the strike price.

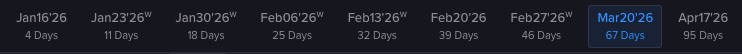

You can choose different time frames for the option expiry. I like to use 3+ month time frame trades.

Why option prices look “weird”

One of the most confusing parts about options is pricing:

The decimal form.

Price is displayed in a decimal form because options represent per-share pricing.

Per share pricing means:

the option costs $795 for 100 shares,

then for 1 share the price is $795/100 shares = $7.95.

The ask price will be $7.95

Each option gives you the right to 100 shares. To buy a call option you need to pay the ask price (the higher one, $7.95) and when you sell you pay the bid price (the lower one, $7.45). So when you buy VRT at $7.95, the price of the option contract is $7.95 x 100 = $795 at $200 strike price. $795 is the option premium.

How beginners get trapped in bad option trades

The biggest silent killer is liquidity.

If a spread is wide, exiting the trade becomes expensive.

But what is a spread?

When you buy, you pay the ask. (the higher price, $7.95)

When you sell, you receive the bid. (the lower price, $7.35)

The difference is called the spread.

In the image above, the spread is $0.6 ($7.95 - $7.35), which is considered quite tight. I only trade options with a tight spread.

Example for a wide spread:

You buy for $7.95 ($795)

The bid is only $4.00 ($400)

You immediately lose $395 just trying to exit

If the spread is wide it’s expensive to exit the contract

How do I optimize the buying price

I always use limit orders at the mid-price.

Mid price is the price between the Bid and the Ask. In the image above this would be $7.65.

Be careful with brokers that advertise “free” trading.

Some platforms are known for poor fills, meaning:

You don’t get optimal pricing

They profit from the spread

The Greeks

Last but not least, The Greeks‼️

You do not need to memorize everything.

Two Greeks matter most for beginners:

Delta

Delta shows how much the option price moves when the stock moves $1.

If delta is 0.31:

A $1 move in the stock ≈ $31 move in the contract

Theta

Theta is time decay.

If theta is -11.85

The position loses roughly $11.85 per day

Because options expire, their value decreases over time.

This is why:

I avoid very short-dated options

I prefer 3+ month timeframes

The payoff: how the VRT trade makes money

Here’s the simplified example:

Buy March $200 call for $7.95

Cost: $795

If VRT rises to $250:

The intrinsic value of the option increases

The contract appreciates dramatically

In this example:

Gross profit: $5,000 ($25,000 sale price - $20,000 purchase price)

Minus premium: $795

Net profit: $4,205

Return: ~529%

Important Note: You don’t need to buy the shares. You can simply sell the option contract itself and realize the profit ($4,205) instantly without needing the $20,000 in capital to exercise the trade.

Why this matters

This is not about hitting home runs every trade.

It’s about:

Limiting downside

Structuring asymmetric bets

Letting winners run when volatility expands

This exact framework is how I structure every trade.

In 2025 alone, using this approach helped me grow my account by 98%.

If this helped, here’s the next step

If this breakdown made options feel clearer than before, that’s intentional.

Inside Constellation Stocks, I publish:

Trade ideas with full logic

Strike selection

Expiration reasoning

Risk management

Exit plans

👉 Subscribe now and as a bonus get my full Option Trading Guide

Let me know which options topics you would like me to cover next:

Talk soon,

Iskan

Founder of Constellation Stocks

About the author

Iskan is a professional trader and investor who managed a private equity fund with $120 million in Assets Under Management. He has invested over $80,000 in his trading education and spends more than 50 hours per week researching stocks.

Disclaimer 1

As a reader of Constellation Stocks, you agree to our disclaimer. You can read the full disclaimer here.

Same query as above

I've just signed up. Have you publish any firm trades to action?