November Performance Recap: Our Portfolio Gained $13k VS Stagnating S&P

Constellation Stocks portfolio outperformed S&P 500 by 7.36%, cumulative YTD return reached +117.76% vs S&P 17.81%

Our portfolio outperformed the market by 110% in 2025

Year-to-date, the Constellation Stocks portfolio is up 117.76% compared with the S&P 500, which is up 17.81%.

There is no magic behind these numbers. It is simply consistent work:

finding strong companies for the long side and weak companies for the short side

spotting valuation catalysts that can play out within 1 to 3 months

building high-ROI option structures for each idea

staying disciplined with risk management

In November, we paid close attention to economic data releases after the government shutdown ended. We needed this to decide the right balance between longs and shorts in the portfolio.

To stay bullish into year-end, I wanted to see two things:

a) expected inflation levels, strong retail sales, solid ISM Services data and a cooling labor market to support yesterday’s Fed rate cut

b) strong earnings and guidance from companies reporting their Q3 results

We got all of that. The extra volatility in November was noise to me, and I remain bullish into the year-end.

We also saw a strong rotation from growth to value stocks and a drop in market breadth. Because of that, I opened shorts in AI-related companies with unproven business models and stretched valuations like AEHR 0.00%↑, and in consumer discretionary names under pressure like CMG 0.00%↑ and HIMS 0.00%↑. On the long side, I added interest-rate-sensitive positions such as the Biotech ETF XBI 0.00%↑ and STLD 0.00%↑, with expirations in February and March next year.

Everything I wrote in the last publication still applies — all of this was covered in detail there.

Considering the stagnating trend of the broad market, November turned out to be a good month for our portfolio.

We closed 23 trades: 13 longs (call structures) and 10 shorts (put structures).

Among these were 11 winning trades with $58,435 in realized gains and 12 losing trades with $44,913 in realized losses. Realized monthly profit was $13,522, or 8% on capital.

The average winner generated $5,312, and the average loser was $3,743.

Average ($) Winner to Loser ratio: 1.42x (5,312/3,743)

Winning to Losing ($) trades ratio: 1.30x (58,435/44,913)

The gains were driven mainly by one trade — puts on CMG 0.00%↑ which brought $22,346 profit.

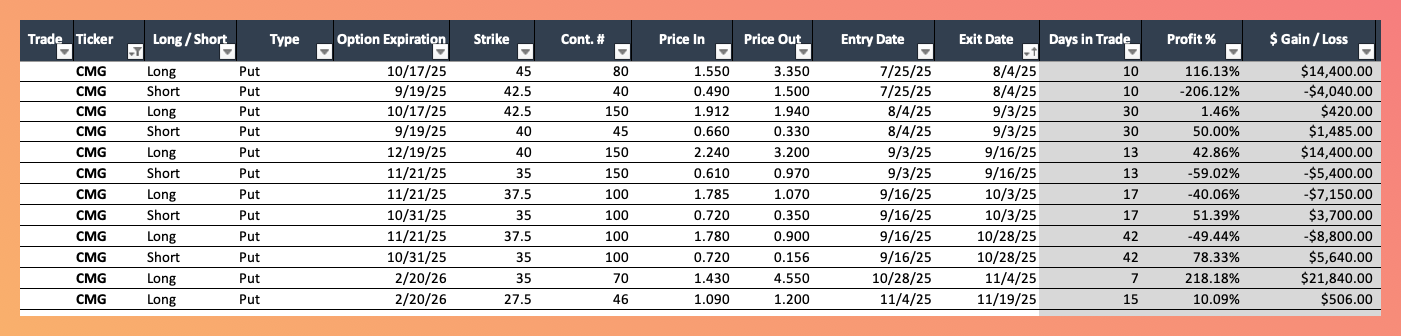

We have been trading CMG 0.00%↑ since July 2025, and in total, it has brought us $37,007 in realized gains. Here is a transaction record:

It is the job of every disciplined trader to maximize the winner-to-loser ($) ratio so you can still earn even when the count of losing trades exceeds winners.

That outcome is only possible when you cut losing positions and scale into winners.

This is how the classic trading dilemma resolves: identify positions that are unlikely to turn into winners over time, cut the losses, and redirect capital to the winners or initiate new, higher-conviction ideas.

Why Long / Short Portfolio

At their core, options allow you to capture non-linear returns from price moves and changes in volatility.

The trap appears when you run only one-sided exposure. If you hold a basket of long calls across names and the market turns, premiums can decay to zero.

The solution is balance. Combining longs and shorts, and carefully selecting underlyings and structures, lets you build a portfolio where winners outweigh losers and the process compounds over time.

To help you become a market-agnostic trader:

choose a strategy that can make money when the market goes up and when it goes down

learn how to spot catalysts that can change a stock’s value

use tools or structures that limit your risk

accept that you may have three losing trades for every one big winner

pay attention to major macro events

YTD Performance

I am running this strategy for the second year.

In 2024, I focused on improving the robustness of the approach and ran many experiments that did not translate into consistent returns, finishing the year roughly flat.

In 2025, I am doing well and deliver value to those starting their journey in trading in general and stock options specifically.

Cumulative YTD Return in November reached 117.76%.

Hope this was helpful.

And if it was, hit reply & let me know.

Talk soon,

Iskan

P.S.: if you want to become a better trader fast, then consider the paid subscription where you get:

a private community

access to analytical tools I’ve built for my own workflow

real-time commentary on how I’m thinking through trades

breakdowns of high-conviction setups I’m watching (to save you 20hrs/week on research)