Market Intelligence Report

What bothered markets on Friday, 3 most probable macro scenarios, Earnings insights, What makes Palantir a great company, 2 current portfolio additions

Macro

Last week’s retrospective:

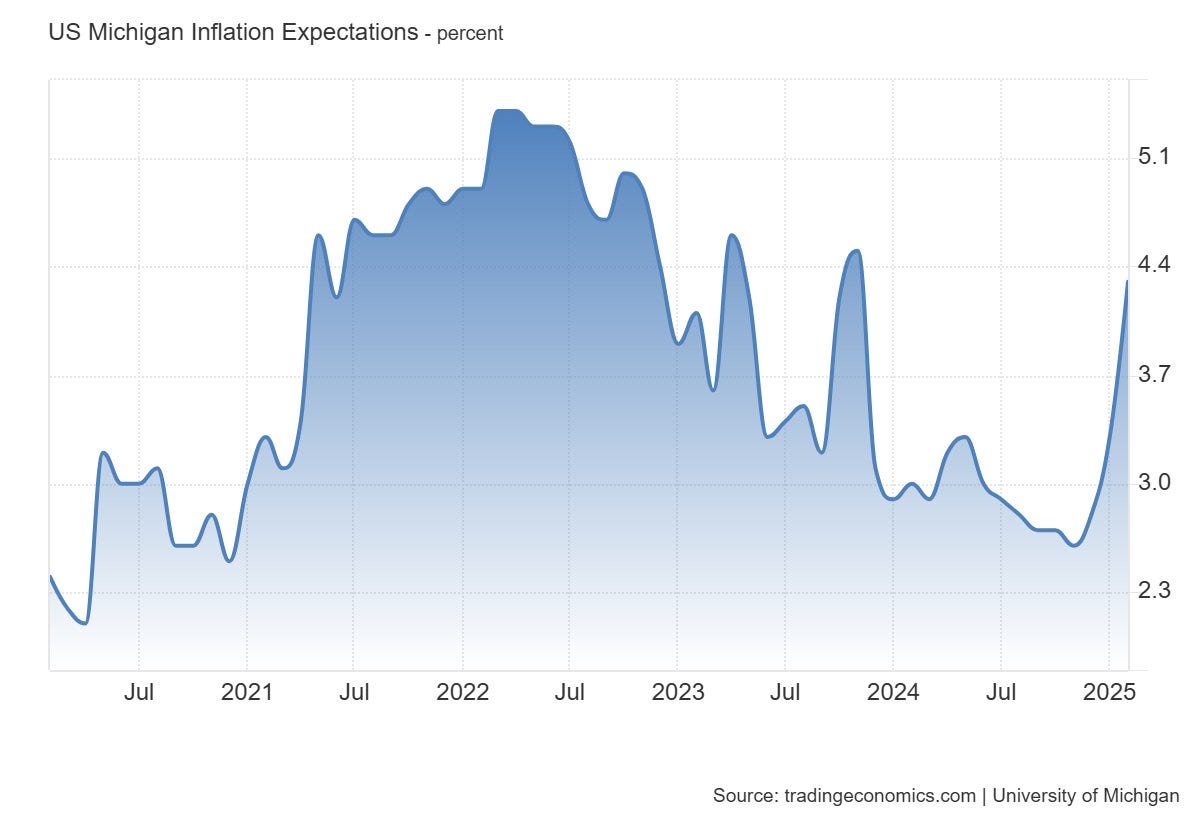

Indeed, the ride was too far from being smooth and Michigan Consumer Sentiment was a piece that brought a new portion of volatility in the markets on Friday.

Year-ahead inflation expectations in the United States climbed to 4.3% in February 2025, the steepest since November 2023. The major indices reacted by falling ~1%.

Sticky inflation is a major risk in the current president's administration. Eyes on CPI data next week.

There are a few more things on macro.

The yield curve inversion is unwinding — the spread between 10Y and 2Y US Treasuries has turned positive again. Historically, this shift has often preceded recessions and market downturns, though with a lag.

Does this mean an imminent bear market? Not necessarily, but it's always a good idea to consider potential risks.

I see 3 of the most probable macro scenarios for the market today:

Soft Landing: inflation decreases, the labor market cools, economic growth is robust => growth and small-to-mid caps outperform the broad market over the next 5-year bull market.

Risk of Recession Materializes => a bear market regime kicks in => rates cut => recovery period after.

Sticky Inflation => no rates cut => economy stays resilient => markets rise until either the Soft Landing or Recession scenarios play out further.

Keep in mind the market lives in the context of Soft Landing today.

Earnings Insights

I often get asked by retail investors where to find trading or investing ideas in the stock market. There is a “chart narrative problem” deeply rooted in the retail market — many traders start and end their analysis with charts.

Imagine if a doctor prescribed treatment based solely on result metrics like heart rate, blood pressure, and body temperature. Trading charts work the same way — they reflect outcomes, not root causes.

The best way to start your investing journey isn’t by analyzing fundamentals right away but by diving into quarterly earnings call transcripts. Here, company management serves as your guide to their industry and business. Reading these transcripts will not only broaden your overall market perspective but also help you develop a personal framework for understanding business models and decision-making based on qualitative factors.

Start with the quarter reports and make it a habit, and you will quickly see how your stock-picking process levels up.

There is a way to optimize this process. I use this Earnings Call Summarizer at work, which saves me hours of reading the call transcripts. Reach out if you want to try it.

I’ve been reading earnings reports lately, enjoy a breakdown of the most valuable quotes from management:

"We did set an all-time record for upgraders, so we've never seen a higher level of upgraders before." - Tim Cook, CEO

"The macro-environment continues to be very, very strong and solid, the labor environment strong, 4.1% unemployment. I think the fundamentals are good and so I think that the hiring and companies still being profitable and there seems to be an awful lot of optimism in the US market in particular." - Don McGuire, CFO

Shane Trigg, President and CEO

"We believe the high interest rate environment will continue to limit our current customers' ability to expand their portfolios."

"The generative AI-powered capabilities of Realm-X, automate routine tasks and key workflows, streamline communications and enable property managers to transform their operational performance."

In the paid section, I cover two promising stock ideas that I personally hold in my portfolio. These stocks benefit from the MAGA (“Make America Great Again”) strategy as a major tailwind and have the potential for significant revaluation. They will be the first additions to the model portfolio this year.

Need more info about the project — read About.