Constellation Stock #2: Robinhood Markets (HOOD) - Growth Story

As Bitcoin ETFs start making headlines, Robinhood's move could mean more growth and a bigger role in blending traditional investing with the crypto world.

Intro

Robinhood Markets is stepping into an exciting phase with the buzz around Bitcoin ETFs hitting the market. This comes right after they launched their crypto operations in the EU, marking a big move into digital currencies.

Bitcoin ETFs could change the game for investors, making it easier to get into crypto without the usual hassle. Robinhood, known for shaking up investing with its easy-to-use app and no fees, is in a prime spot to benefit from this. They've made investing more accessible to everyone, and jumping into crypto in the EU shows they're ready to ride the next big wave.

As Bitcoin ETFs start making headlines, Robinhood's move could mean more growth and a bigger role in blending traditional investing with the crypto world. Keep an eye on Robinhood; they're gearing up for an interesting ride.

Company Overview

Founded in 2013 and headquartered in Menlo Park, California, Robinhood (HOOD) stands out as a transformative force in the U.S. financial services sector.

Sector: Financials

Industry: Capital Markets

MCap: ~$14.05 B

Stock Price: $16.63

Shares out: 764.89M

Short Interest: 3.59%

Last Earnings Date: 13 FEB 2024

Its core mission—to democratize finance for all—resonates throughout its operations, pushing the boundaries of traditional investing by making financial markets accessible to a broader, younger audience. Robinhood offers commission-free trading, significantly lowering the cost of entry for new and retail investors.

At its core, Robinhood's brokerage offers access to trading stocks, ETFs, options, gold, and fractional shares, and gives access to margin trading. The platform also introduces users to the IPO market and provides liquidity solutions like instant withdrawals. Robinhood extends its no-commission policy to the cryptocurrency market, where users can trade select cryptocurrencies without fees.

Beyond its trading platforms, Robinhood diversifies its offerings with Robinhood Gold, providing premium features like enhanced interest rates on cash and access to in-depth market research, along with Robinhood Retirement accounts, digital wallets, and a recent new feature, Robinhood Markets 24h, that allows users to place bids 24/7.

Revenue Streams

Transaction-based sources (60% of revenues): rebates from market makers and trading venues, which are a form of payment for order flow (PFOF).

Net Interest Revenue (~30% of revenues): margin interest charged to customers who borrow funds to trade, income generated from uninvested cash in users' accounts, and stock loan revenue from lending securities to other financial institutions.

Gold subscription: enhanced features such as professional research reports, level II market data, and increased buying power through margin trading.

Recent Company News

Feb-2024: Robinhood announced a partnership with Consensys, the leading blockchain and web3 software company to launch the integration of Robinhood Connect with MetaMask, the world’s leading self-custodial web3 wallet.

Q4 2023: Robinhood launched Crypto Trading in the European Union.

Q3 2023: Robinhood acquired the San Francisco-based credit card platform X1 for $95 million in cash.

QUANTS

Financial Outlook

Recent financial results in Q4 2023 underscore a transformative phase, with a remarkable 37% y/y surge in annual revenue, reaching a record $1.9 billion, highlighted by a quarterly revenue of $471 million. This growth was propelled by a 41% increase in net interest revenue to $236 million, tailwinds to favorable interest rates.

Additionally, the company's diversification into cryptocurrencies and equities significantly contributed to an 8% y/y rise in transaction-based revenues, amounting to $200 million by the end of Q4.

Robinhood ended Q4 2023 with EBITDA margins of 28%, up 600 basis points from the same period a year ago, indicating effective expense management, including reducing stock-based compensation.

The number of funded customers increased by approximately 420 thousand y/y to 23.4 million in Q4. They also saw remarkable growth in customer metrics, with funded customers reaching 23.4 million and Assets Under Custody (AUC) expanding by 65% to $102.6 billion.

Still, there is some decrease in cash and cash equivalents, primarily due to strategic share repurchases and active M&A policy.

2023FY was the first period when the company reached positive $0.49 EPS (Non-GAAP), it marked a significant improvement from -$0.99 earnings per share from the prior year.

Source: Robinhood's official website

Q42023 Earning Key Management Comments

“So as rates move, we do not anticipate a significant change in the yield we earn on cash sweeps. And third and most importantly, declining interest rates tend to support growth in assets, balances and trading. So we think 2024 is the year when we'll see interest rates shift from being a headwind for our business growth into a tailwind”

“We grew revenues 37% to $1.9 billion; delivered adjusted EBITDA of $536 million, which is more than 3x our prior high; drove 124% incremental margins as revenues grew by more than $500 million, even while we lowered costs.”

"Trading market share was up 14% for equities and 19% for options year-over-year. Gold subscribers were up 25% to $1.4 million, and assets under custody exceeded $100 billion, fueled by the strength of our 27% organic growth in net deposits."

Tailwinds

Continuing diversification of revenue streams with Gold subscribers in Q4 increased 25% y/y to 1.42 million.

Beginning of global expansion with launch brokerage in the UK, and crypto in the EU.

Active M&A policy.

Headwinds

Ongoing and future regulatory developments could impact Robinhood's business model.

Earnings from transaction-based revenues and net interest might be vulnerable to market fluctuations and changes in interest rates.

Meme stock company reputation.

Concerns regarding the slowing of user growth, with a 4% y/y decrease in Monthly Active Users (MAU), dropping to 10.9 million.

Industry Comps Analysis

Source: Stockpickingsouk

Robinhood’s valuation looks much higher than its peers in the industry. The market could expect significant Earnings Growth revisions in the upcoming quarters that sound reasonable since the current EPS consensus looks too pessimistic.

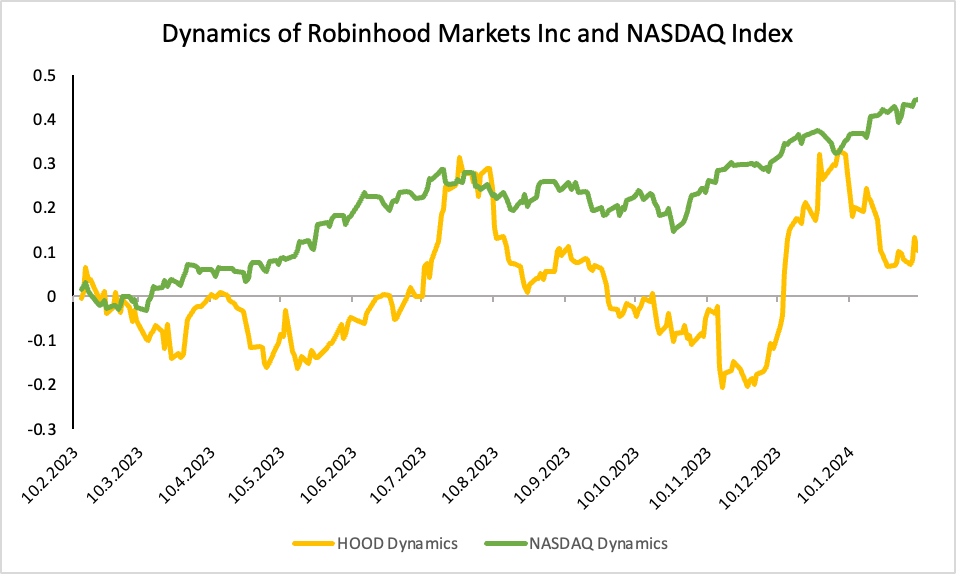

Price Action and Benchmarking

Source: Yahoo Finance

Key Risks

Robinhood's user base primarily consists of accounts with an average value of around $4,000, many of which may not grow significantly.

A year-over-year decrease of 4% to 10.9 million MAUs raises concerns about user engagement and the platform's ability to attract and retain users in a competitive landscape.

Robinhood operates in a highly regulated industry, and any changes in securities regulation could affect its business model, especially concerning commission-free trading and payment-for-order flow practices.

Meme Stock Company Reputation. The operational challenges and public backlash during the GameStop trading highlighted potential weaknesses in Robinhood's infrastructure and risk management practices. These events have had a lasting impact on Robinhood's reputation, although efforts to rebuild trust and enhance system robustness are underway.

Stock Price Target Estimate

Source: Stockpickingsouk

The company has a good chance to beat the earnings consensus in upcoming quarters and the stock price target estimate range of $23-25 looks enough reasonable, given the tailwinds stated above.

Earnings and Sales Revisions by Analysts

Comments from the Q4 earnings call highlighted plans for strong growth in 2024, driven by continued 20-plus percent net deposit growth. The company aims to deliver another year of revenue growth and margin expansion, supported by an upward revision in Robinhood's sales estimates. And the probability of revisions for Earnings rises every day.

Disclaimer

Co-Author: Katerina Kiseleva

Please note that this article represents just one piece of a comprehensive equity research report we prepare on every potential investment idea we consider adding to our portfolio. This content is for informational or educational purposes only and is not to be taken as personalized financial advice. Happy investing!

Remember, all investments carry risk. It's important to practice diligent risk management and conduct your research before making any investment decisions. This content is not intended to provide investment advice.