August Recap: Navigating Low Volatility in Options Trading

Breaking down my August performance: 17 trades, 1.47x win/loss ratio, and the golden rule of options trading

Key Takeaways

📉 August closed with –$12,674 net loss on 17 trades.

✅ 6 winners averaged $8.8k; ❌ 11 losers averaged –$6k.

⚖️ Winner/Loser ratio: 1.47x with only 1/3 profitable trades.

🎯 Breakeven possible with a ratio near 2x or a few more winners.

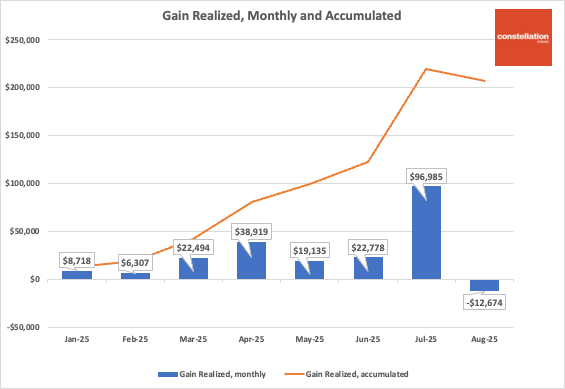

📊 YTD: +$200k realized returns (102.5% on capital).

⚡ Core lesson: balance longs and shorts, pick trades with strong volatility profiles, and act early to fix or restructure.

Hi everyone,

Happy Labor Day!

August was a hard month with quite low volatility.

I executed 17 trades:

9 longs (call structures)

8 shorts (put structures)

Performance breakdown:

✅ 6 winning trades → +$53,028

❌ 11 losing trades → –$65,702

Net P/L: –$12,674

This highlights the beauty of options trading: you can still win even with fewer winners than losers.

Average winner: $8.8k

Average loser: –$6k

Winner/Loser ratio: 1.47x

Only 1/3 of trades were profitable

If I had pushed the ratio closer to 2x or added just one or two more profitable trades at my average win size, August would have been breakeven.

⚡ Golden rule in options trading: You can be wrong more often than right - but if your winner/loser dollar ratio > 2x, you’ll make money over time.

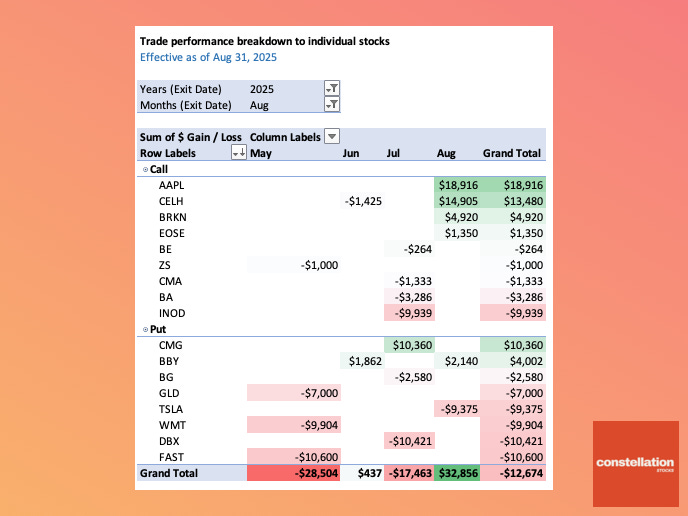

August option contracts exposure is shown by the month of trade entry in columns:

What dragged performance down was the lack of high-volatility ideas.

My winners AAPL 0.00%↑ CELH 0.00%↑ BIRK 0.00%↑ and CMG 0.00%↑ didn’t have enough volatility in their profiles. In options, selecting trades with the right volatility is always crucial.

I also carried GLD 0.00%↑ WMT 0.00%↑ and FAST 0.00%↑ trades from May that I eventually wrote off. In hindsight, it would have been better to fix or restructure them earlier.

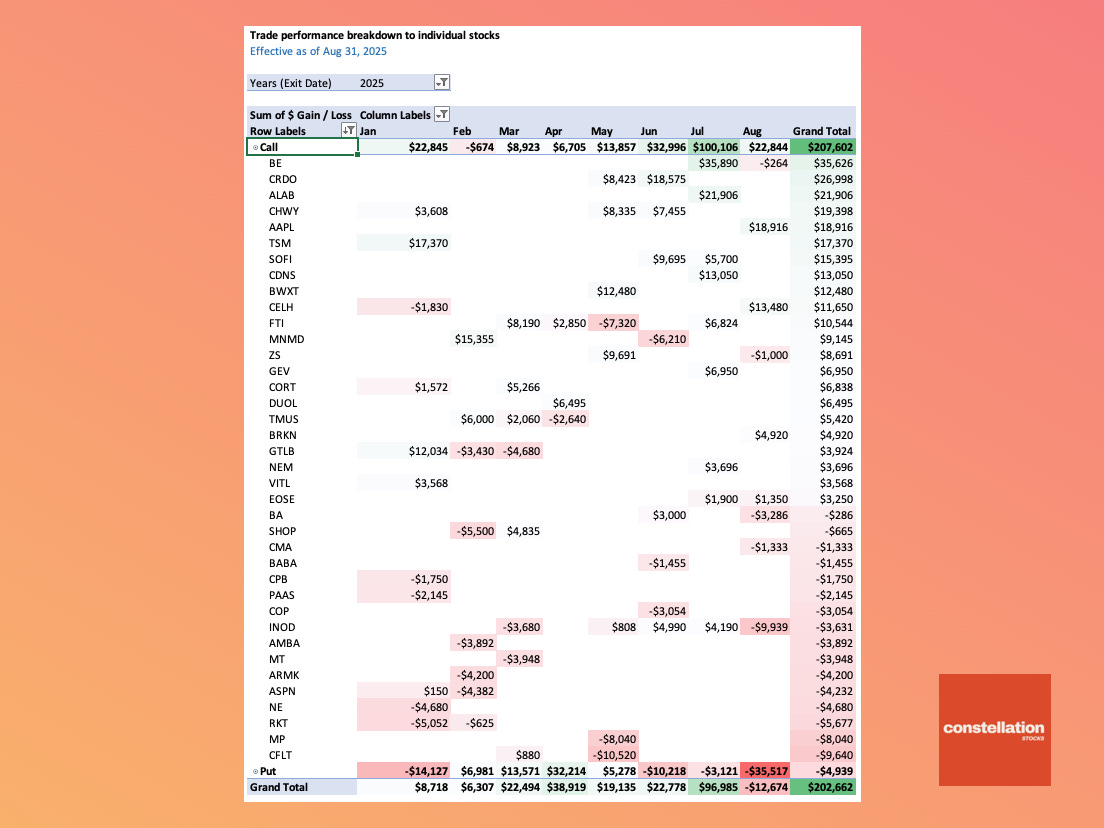

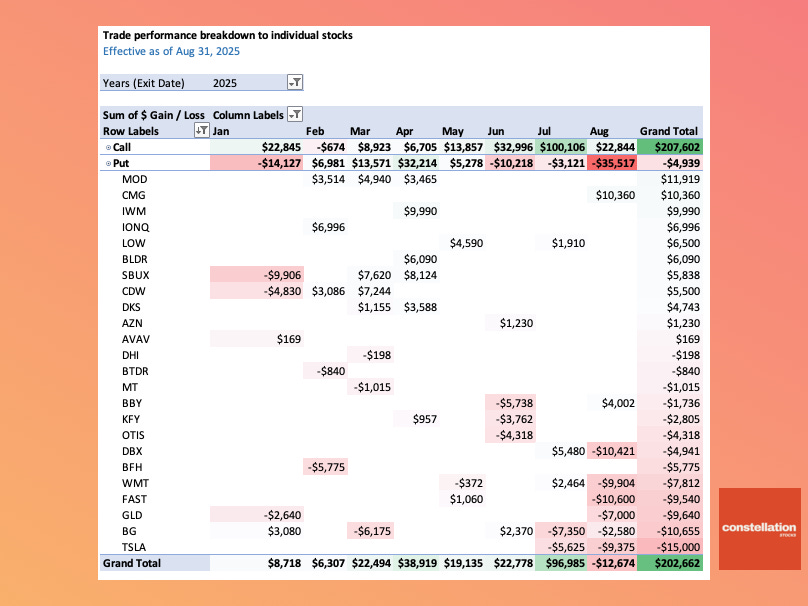

YTD Performance

Overall, 2025 has been favorable.

I’ve generated around $200k realized returns, equal to a 102.5% return on capital under management.

Breakdown by strategy:

Calls: Efficiently captured the market rebound in July.

Puts: Benefited from the April tariffs-related volatility spike.

Why Long / Short Portfolio

At their core, options let you make non-linear returns on stock price movements and volatility.

But here’s the trap: if you only hold one-sided trades (say, a bunch of long calls on different stocks) and the market turns against you, all those premiums paid can expire worthless.

The solution is balance. By combining longs and shorts, and by carefully selecting stocks and option structures, you can build a portfolio where winners outweigh losers and the system works over time.

More in the Options Playbook

Alongside these monthly performance reports, I also share real-time trade actions and market views in the Options Playbook section of this newsletter.

👉 Consider becoming a paid subscriber to access everything and stay aligned with my trading journey.

You can also check the About section for more on me and the project.

📘 All subscribers receive a free guide with theory and practical cases in stock options trading.