Constellation Stock #1: Wayfair (W) - Turnaround Story

The Russell 2000 Index is Poised to Surpass Its 2-Year Price Range. Discover the Companies Set to Benefit. Here is one of them. Not an investment advice. Do your own research before any action.

Intro

In the heart of the US economy, small-cap stocks have weathered the storm of inflationary pressures and recession fears over the last two years. But what's the latest buzz from the markets, and what can we expect moving forward? Recent developments suggest a base case scenario where the Federal Reserve hits its inflation targets, maintains a strong labor market, and begins to cut rates, all while sidestepping further recession risks. This optimistic outlook is currently supported by a broad range of data, signaling a possible 'soft landing' for the economy.

While it's wise to stay alert to potential tail risks like persistent inflation, recession, or stagflation, there's no immediate evidence suggesting these concerns are imminent. In this context, it may be prudent to take the market as it comes, rather than attempting to outguess its next moves.

Diving into this scenario, I've been on the lookout for companies that stand to gain significantly from a soft landing — particularly those poised for a turnaround. These are firms that have faced challenges but are on the cusp of a significant rebound. A prime example of such a turnaround story is Wayfair, which has recently shown promising signs that merit a closer look.

Company Overview

Wayfair Inc. (NYSE: W), established in 2002 and headquartered in Boston, Massachusetts, stands as one of the premier global retailers in the home sector. Specializing in e-commerce, Wayfair offers a vast array of approximately 40 million products spanning furniture, décor, housewares, and home improvement. Its diverse brand portfolio includes Wayfair, Joss & Main, AllModern, Birch Lane, Perigold, and Wayfair Professional, catering to a wide range of consumer tastes and preferences.

Sector: Consumer Cyclical

Industry: Internet Retail

Last Close Price: $54.04

Shares out: 116 mln

MCap: ~ $6 bln

Last Earnings Date: 23 FEB 2024

Short Interest: 17%

Global Infrastructure

The company boasts an extensive operational ecosystem, with 18 fulfillment centers and 38 delivery centers across the U.S., Germany, Canada, and the U.K., underpinning its logistics capabilities. Additionally, its Sales & Service teams, spread across the U.S., Germany, Ireland, Canada, and the U.K., alongside a virtual team, ensure comprehensive global customer support.

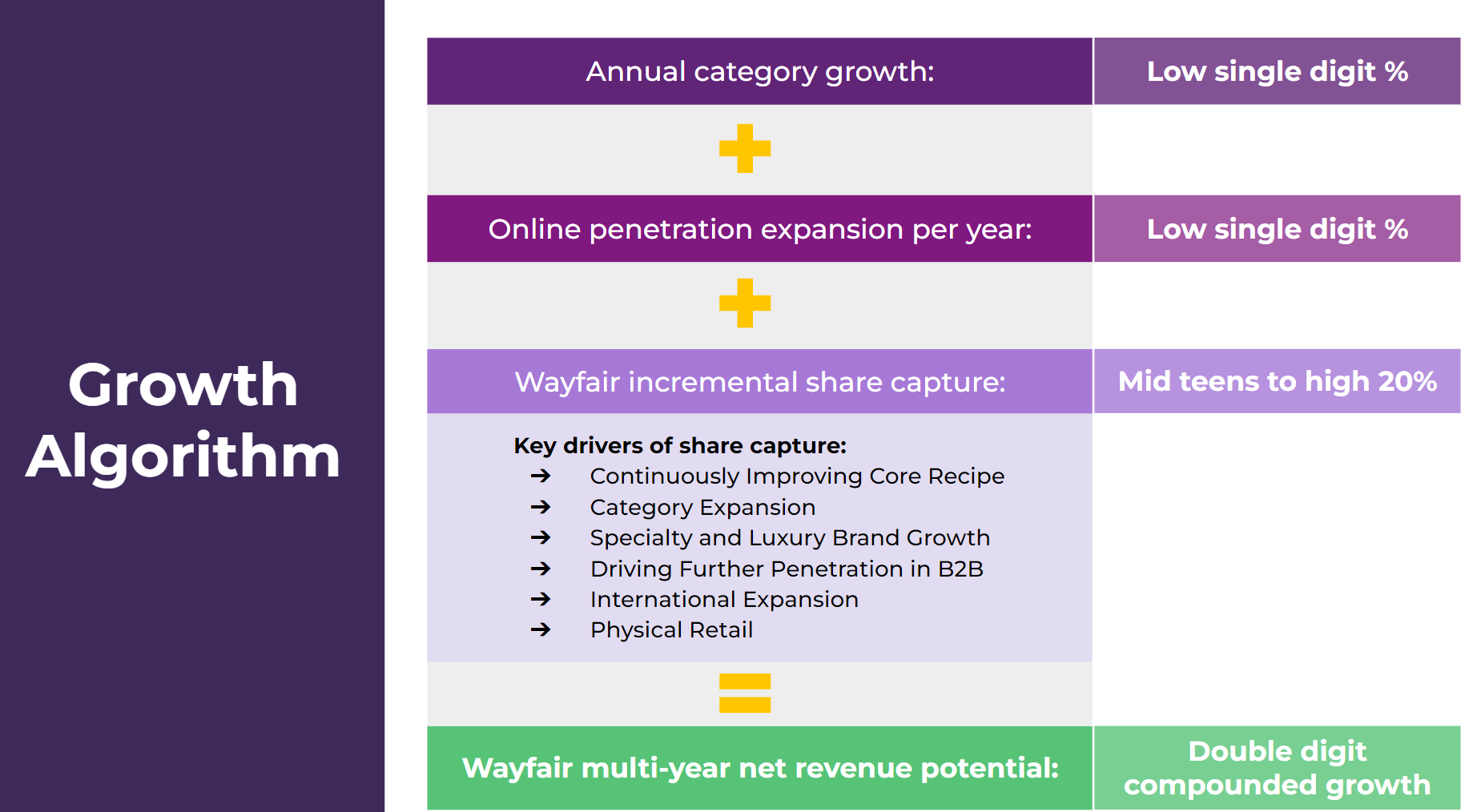

Market Potential

The company operates within a substantial total addressable market (TAM) exceeding $800 billion, focusing exclusively on the home category with a vision to expand its TAM to over $1 trillion by 2030, attributed mainly to international expansion efforts. Wayfair's unique value proposition is supported by proprietary technology, a robust logistics network, deep supplier relationships, and a platform business model, offering unparalleled product variety and value to shoppers.

Financial Outlook

Wayfair has demonstrated significant financial growth, with annual revenues reaching $12 billion. Despite historical challenges in scaling and profitability, recent strategic initiatives, including a $1 billion cost restructuring plan and a 10% reduction in workforce, have begun to yield positive results. Improvements in logistics efficiency and competitive pricing strategies have enhanced supplier engagement and customer satisfaction. These measures have contributed to a reversal in sales declines, with a 0.4% YoY sales increase in 4Q23, marking the third quarter of positive free cash flow and an adjusted EBITDA of $92 million.

QUANTS

Stock Price Target Valuation

Source: Stockpickingsouk.com

The price target derived from the Market Cap/Sales multiple forecasted at 0.96x (equal to the multiple in FY21 before the inflationary pressure environment started), implying an upside return of ~100% from the current share price. Taking into consideration a more robust business model today than it was in 2021, this scenario looks more like a pessimistic one.

Price Action and Benchmarking

Source: Koyfin

Wayfair’s stock dropped from over $340 in March 2021 to just $33 by the end of 2023.

On Jan 23rd, the furniture retailer’s stock surged by 20% after laying off 10% of its global workforce.

On Jan 19th, 2024, the stock surged >10% on the news of a further cut of 13% of the workforce.

Wayfair is a composite of the Russell 2000 index. Stock price shows significant volatility with a sharp peak and trough mid-year. For most of the year, the stock underperformed relative to the Russell 2000 index, which is a small-cap stock market index.

Source: Yahoo Finance

Q42024 Earnings Key Management Comments

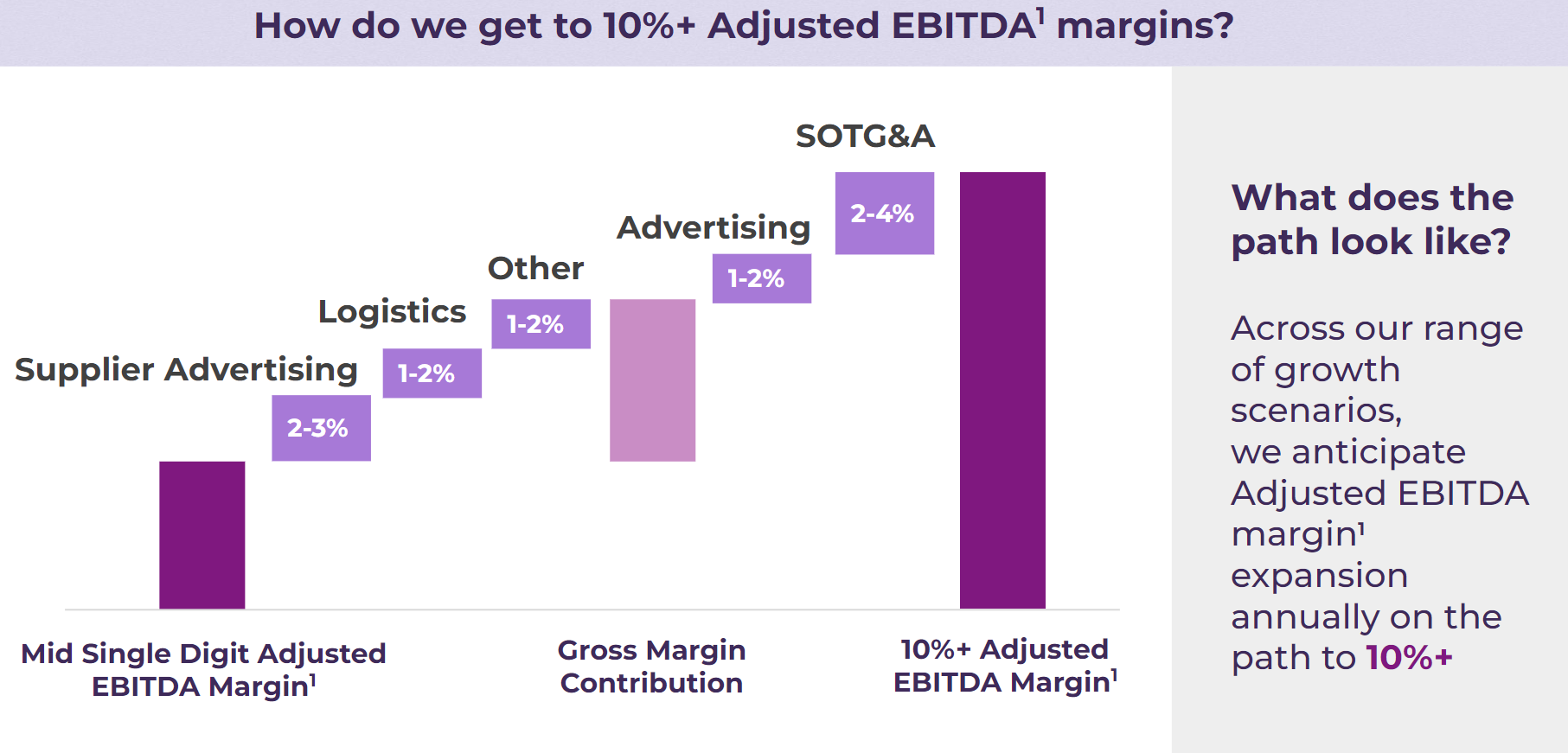

We have already removed close to $2 billion of various costs, and as a result, this year we will have mid single digit Adjusted EBITDA even without any growth. As we grow, the flow through of earnings on additional revenue is very high - for example, the next billion will flow through to Adjusted EBITDA in the mid to high teens percentage range. And this is what puts 10%+ Adjusted EBITDA in sight.”

“Our efforts over 2023 led to large improvements in our core recipe across availability, speed and price competitiveness. These improvements were directly responsible for our robust share expansion throughout the year and for the step-up we saw in customer loyalty, including year-over-year growth in our active customer count by the fourth quarter.”

“At just $12 billion dollars of our more than $800 billion dollar addressable market, or less than 2% market share, we still have so much left to work for.”

Recent Company News

FEB-6: Wayfair Announces Decorify App for Apple Vision Pro

Wayfair's virtual room styler and 3D imaging tools enable Apple Vision Pro users to reimagine their living spaces and experience the future of shopping in their home.

Share price +2,6% on the day of the news, almost no fluctuations, showcasing a weak market reaction.

JAN-2024: Plan To Further Eliminate 13% Of Global Workforce

Wayfair announced plans to reduce its global workforce by 13%, a strategic move expected to generate annualized cost savings exceeding $280 million.

The savings are distributed across several areas: $125 million in SOTG&A, $25 million in CS&M, $80 million in equity-based compensation relief, and $50 million in capital expenditures (capex). Despite these savings, the company anticipates incurring severance costs of $70-80 million in the first quarter of 2024. Furthermore, Wayfair has provided guidance for an adjusted EBITDA of $600 million for FY24, based on the assumption of flat revenue growth. Share price experienced a significant uptick, rising by 10% on the day the news was released.

Industry Outlook

As the e-commerce industry braces for 2024, Wayfair is positioned to navigate and potentially thrive amidst the complex dynamics of slowing economic growth yet increasing online consumer spending. Surveys, including one conducted by Bank of America, suggest a paradoxical scenario where, despite a deceleration in GDP growth, e-commerce is poised for acceleration. This anticipated growth is underpinned by several factors including diminishing headwinds from the reopening of economies, enhancements in omnichannel and local delivery services, and a consumer base increasingly focused on value—a domain where Wayfair, with its vast selection and competitive pricing, excels. Furthermore, the industry outlook suggests a conducive environment for the home goods sector, driven by expected reductions in inflation and interest rates.

The potential of artificial intelligence (AI) in refining e-commerce operations presents another avenue for Wayfair to solidify its market position. Leveraging AI for enhanced product and content recommendations, alongside more dynamic pricing strategies, could significantly improve customer experience and operational efficiency.

Industry Competitors Analysis

Source: Stockpickingsouk

Amazon and Home Depot could be considered close competitors due to their large presence in the home goods and improvement market but at the same time, they have way different business models.

Wayfair's multiples indicate an interesting picture. The high P/E ratios could reflect investor confidence in Wayfair's future earnings growth, supported by the extraordinarily high earnings growth figures. The low PEG ratios, especially for the following year, could signal that Wayfair's stock might be undervalued if the earnings growth forecasts materialize.

QUALS

Wayfair’s Strategy

The company's innovative approach to brand development, particularly through its house brands, which now account for approximately 70% of sales. This strategy, coupled with ongoing efforts to enhance product assortment and customer experience, positions Wayfair favorably for continued growth and market leadership in the online home goods sector.

Focus on cost control & compounded growth

Supplier Advertising: scaling penetration within our existing sales base.

Logistics: efficiencies in the supply chain.

Other: combination of merchandising and mix, primarily expanding the mix of higher-value segments (higher-end retail brands and professional platform).

These levers will contribute to the gross margin target in the mid-30%s

Advertising: higher efficiency in paid channels as well as higher leverage of free traffic. Potential for even more significant gains in advertising.

SOTG&A: driven by revenue leverage (SOTG&A will grow slower than revenue growth).

Key Risks

Wayfair’s increased advertising spending might impact profitability. The company needs to continuously spend to expand its customer base. Moreover, roughly 70% of Wayfair’s online home products can be found on Amazon with similar pricing on the latter’s website. Therefore, Wayfair may have to reduce its prices or spend more on advertising thereby keeping its margins under pressure.

Disclaimer

Co-Authors: Michele Filippig, Katerina Kiseleva

Please note that this article represents just one piece of a comprehensive equity research report we prepare on every potential investment idea we consider adding to our portfolio. This content is for informational or educational purposes only and is not to be taken as personalized financial advice. Happy investing!

Remember, all investments carry risk. It's important to practice diligent risk management and conduct your research before making any investment decisions. This content is not intended to provide investment advice.