Reactive Risk Management in Choppy Markets

October monthly options expire today.

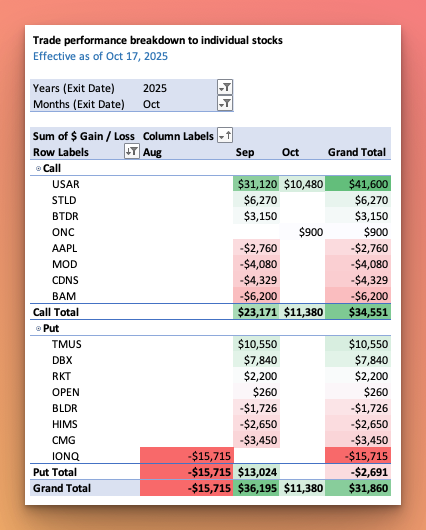

I closed the OTM (out-of-the-money) short legs with today’s expiration, receiving $900 in credits for the $ONC calendar spread trade, which now will be pushed forward to earnings. It can become a high ROI trade if earnings play out as I expect.

I booked $41,600 profits for my $USAR trade, which was a Dec/Nov calendar spread - the in-the-money leg with strike $21 brought me $31,120, and a short leg with strike $30 brought another $10,480. This trade proved to be one of the most successful of the year, both in terms of structuring techniques and P&L results. I executed this trade back in September and was residually increasing exposure up to .4x of a normal position size, and to maximize the return, I sold the short leg with a strike $40 in October, which wasn’t optimal, as if I hadn’t done that, the long leg wasn’t capped and would have brought more money. But risk management is a priority, especially for trades bringing 500% on premium paid like this.

When I close this kind of massive gains, I also prefer to cut some losing positions or restructure - I closed short on $IONQ opened back in August, booking the -$16k loss, and long $AAPL, having already the short leg closed with a premium earlier but having the long leg losing. I closed the long leg and got the total -$3k loss from $AAPL this month.

My net gains were $23,500 today, turning the monthly results to $31,860.

I opened a new short-term tail risk trade on one of the regional banks, in case more problems are discovered in the banking system during this earnings season.

For the long side, I re-entered $USAR and am thinking about opening new positions with the REE theme.

Happy Friday and Weekend!