Macro Insights #2

Inflation Trends and Corporate Performance

In previous Macro Insights, we focused on inflation as a major concern for the markets. We also introduced three potential scenarios the global markets could follow, depending on how successfully the Fed achieves its inflation target.

Since then, there have been new inputs that signal the soft landing scenario is still alive. Let’s have a look.

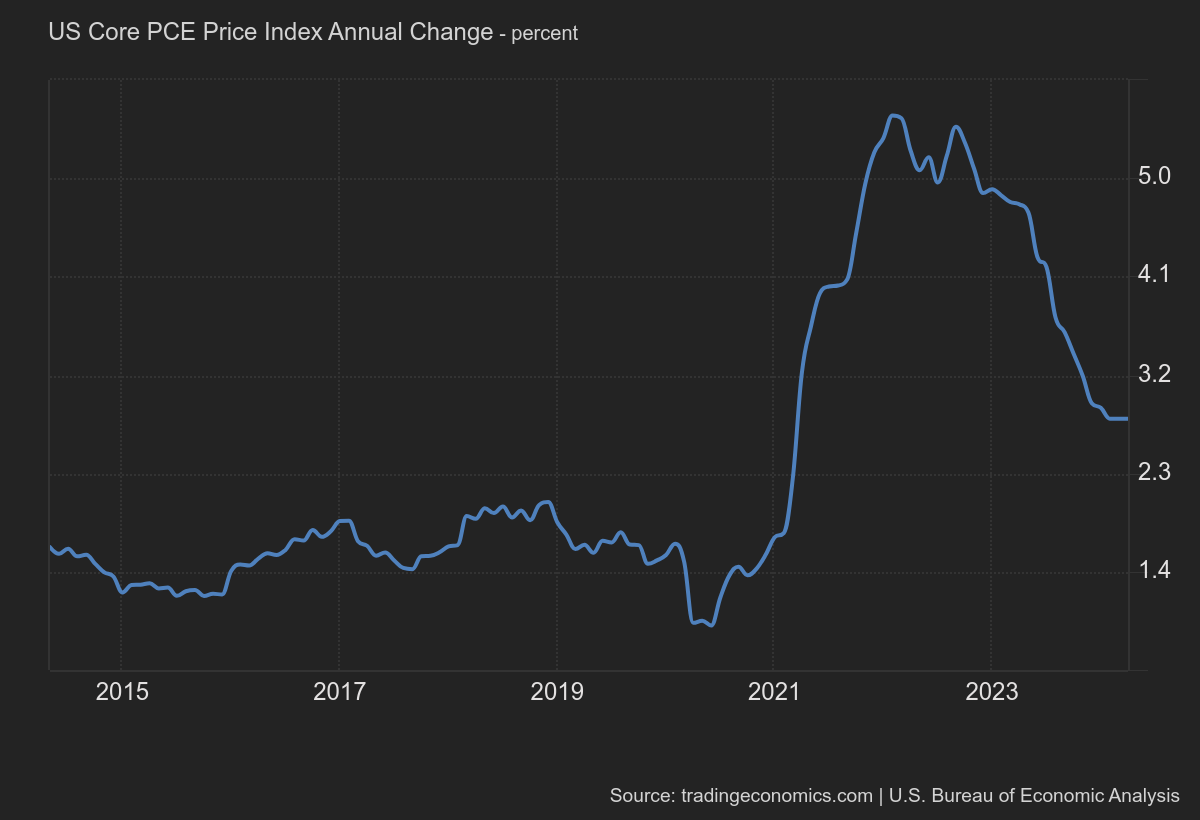

US Inflation Data

The Consumer Price Index (CPI) for April showed a year-over-year increase of 3.4%, down from 3.5% in March. The Core CPI, which excludes volatile food and energy prices, decreased to 3.6% from 3.8% in March.

The Personal Consumption Expenditures (PCE) price index, the Federal Reserve's preferred measure of inflation, increased by 2.7% year-over-year in April, the same rate as in March. Core PCE, which excludes food and energy, rose by 2.8% year-over-year, consistent with the previous month's figures also.

Labor Market Conditions

The Job Openings and Labor Turnover Survey (JOLTS) for April reported that job openings fell to 8.059 million, the lowest level since February 2021, down from March's revised level of 8.355 million. This decline indicates a decrease in labor demand, although hires and total separations remained relatively stable at 5.6 million and 5.4 million, respectively.

There were a bunch of other economic indicators released, but we wouldn’t say that they have impacted the whole picture. Now all eyes are on the Non Farm Payrolls and Hourly Earnings data release on Friday this week.

Q1 2024 Earnings Post-Season: How did it go and what to expect in Q2?

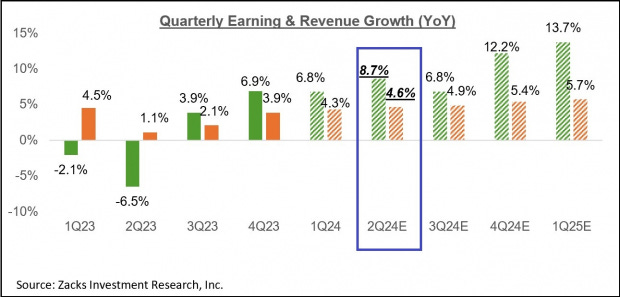

Besides the macro level, we would like to shed some light on the performance of the corporate side of the economy and what the market expects from them in terms of further revenue and earnings.

Total earnings for the S&P 500 members that have reported Q1 results are up +𝟲.𝟴% from the same period last year on +𝟰.𝟯% higher revenues, with 78% beating EPS estimates and 60% beating revenue estimates.

For 2024 Q2, the market expects a continuation of the earnings recovery period with earnings up +𝟴.𝟳% on +𝟰.𝟲% higher revenues.

In Q1 results, we often saw management concerned about weakening demand, especially for consumer-driven companies, leading to better traction in earnings rising faster than revenues. 2025 is expected to be better for revenues. We will see.

Summary

The soft landing scenario for the economy remains possible, with April's inflation showing moderation; the CPI increased by 3.4% year-over-year, and the PCE index rose by 2.7%. Job openings were at their lowest since February 2021, indicating a decrease in labor demand.

On the corporate side, Q1 2024 earnings for S&P 500 companies increased by 6.8% from the previous year, with expectations of continued earnings recovery in Q2.