Defending my 102.5% YTD return against market volatility

How I’m positioning for rotation, sticky inflation, and potential volatility spikes

My Market View

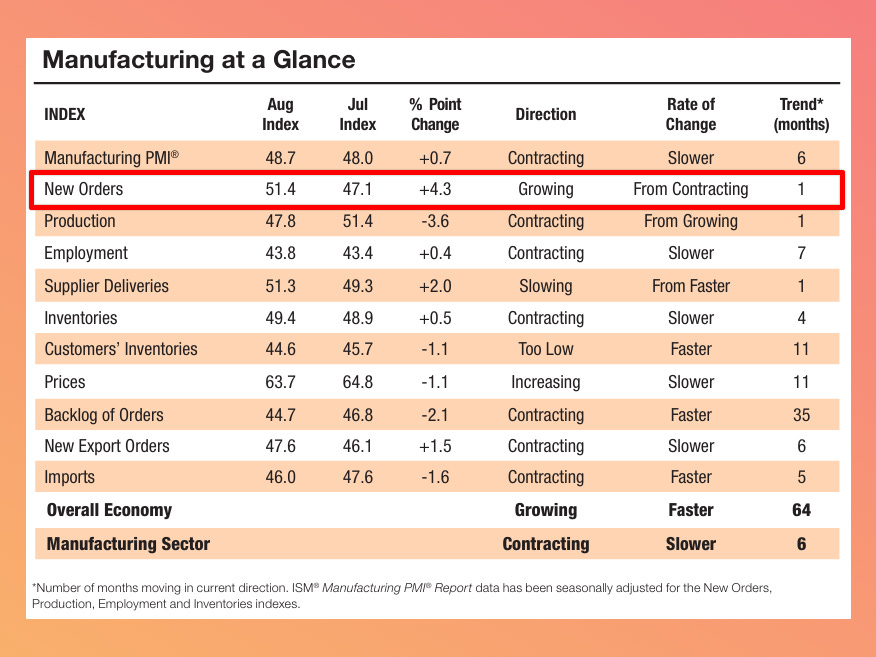

September began with weak ISM Manufacturing PMI data for August. At this point, such weakness feels almost routine - it’s been happening for months.

One detail I paid close attention to: New Orders flipped from contracting to growing. That’s a positive sign but one month of improvement isn’t enough to establish a trend. It could just as easily flip back. For now, nothing fundamentally new for the markets.

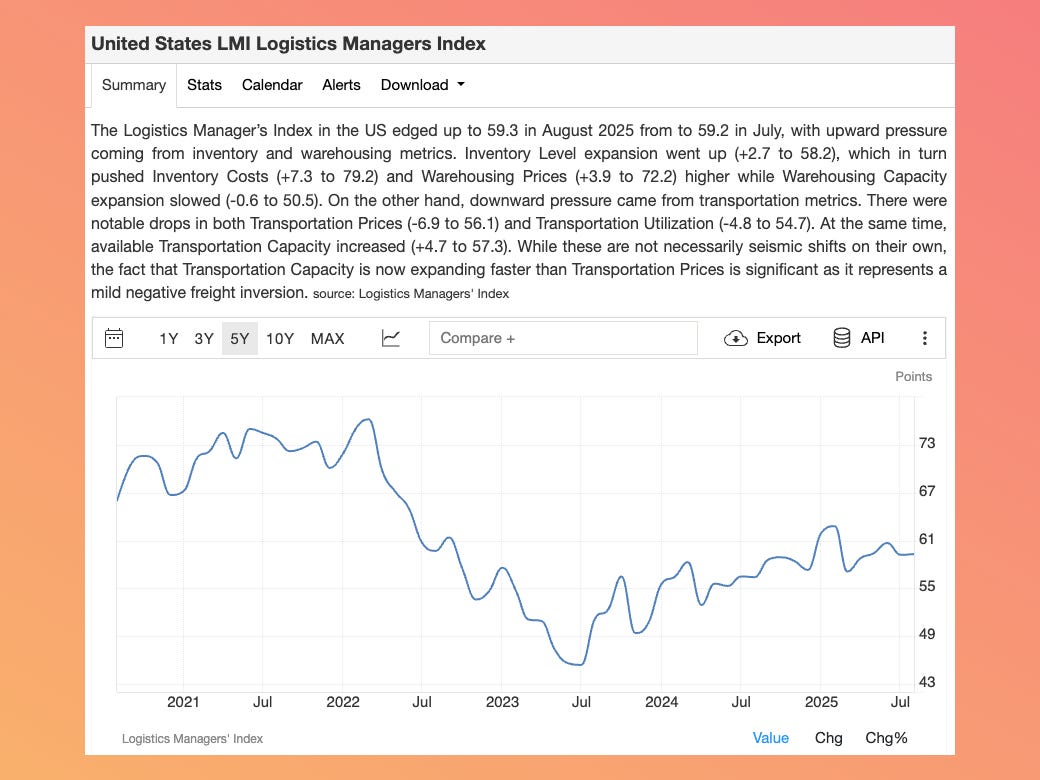

This data pairs well with the Logistics Manager’s Index released the same day. Companies built up solid inventories in August and weren’t in a hurry to replenish them.

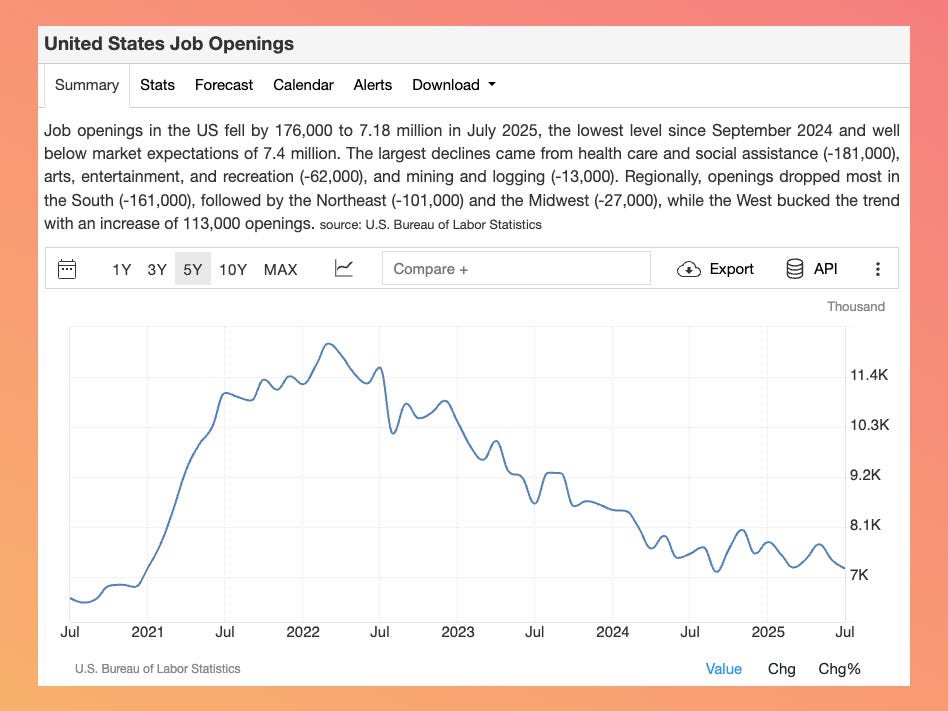

Meanwhile, job openings confirm a cooling labor market.

I expect more volatility once we get fresh data on business and consumer health - the ISM Services PMI and employment data due tomorrow and Friday will be key.

My L/S Stock Options Portfolio Positioning

I’m working to keep my long/short options book aligned with potential outcomes the financial markets could face this quarter.

Scenarios I’m watching:

Rotation.

From AI hardware-driven industries toward software (previously pressured by AI replication risks) and defensive sectors like Consumer Staples and Healthcare. In this case, the broad market could be slightly lower or flat in September, then push higher into year-end. That keeps us within a bull market framework.

Fear of recession.

If labor market deterioration accelerates and rate cuts fail to stabilize conditions, consumer discretionary spending will stay weak. This could trigger a correction across most sectors.

Sticky inflation.

Inflation holding steady in its current range wouldn’t necessarily hurt markets - as long as corporate profits remain intact and consumers stay resilient.

Right now, I see a mix of scenarios 1 and 3 playing out, and I’m managing my portfolio accordingly.

👉 Inside the paywalled section:

Full long/short options portfolio (tickers, position sizes, expiries)

Detailed reasoning behind each trade

The sectors I see as the next volatility catalysts

📊 YTD, this strategy is up +102.5% on capital - and these are the actual trades driving that performance.

📩 Upgrade to a paid plan to unlock the full breakdown