Constellation Stocks 5 & 6: StoneCo (STNE) & Nubank (NU) - Growth Stories. Part II

Nubank is setting the pace in Latin America's digital banking revolution, with impressive growth metrics and strategic expansions.

Intro

Today, we continue talking about the ideas in the emerging markets that can be potentially attractive in the context of a soft-landing scenario realization and soon, rate-cut expectations. As with StoneCo (STNE), Nubank (NU) stands at the forefront of Brazil's fintech revolution and, with its strong consumer-centric approach, is reshaping the B2C financial landscape by offering intuitive and accessible financial services to millions.

Highlights

Market Position and Competition

Nubank is pioneering digital banking in Latin America, serving as a market leader with significant brand loyalty and customer engagement. With less than 5% of the financial services revenue on the continent, there's substantial room for growth, especially in mobile-driven markets like Brazil, Mexico, and Colombia.

Financial Performance

In Q4 2023, the company’s revenue surged to $2.4 billion, a 66% increase year-over-year, and net income reached $360.9 million, reflecting a robust return on equity of 19.5%. Customer growth was also strong, with 19.3 million new customers added in the year, reaching a total of 93.9 million globally.

Management Guidance for 2024

The management outlined priorities for 2024, focusing on scaling operations in Mexico, ramping up secured lending in Brazil, and expanding into high-income segments. They are confident about surpassing the 100 million customer milestone and continuing robust revenue and profit growth.

Challenges and Opportunities

Regulatory complexities in multi-country operations and funding cost management in Mexico present significant challenges. However, opportunities arise from new product introductions, like secured personal loans and payroll loans, which could broaden market share and enhance customer retention.

Price Action

The company's stock has outperformed the Nasdaq Composite Index by three times in the past year. This performance, combined with the first positive GAAP earnings year in 2023, positions NU attractively for potential investors, particularly those managing limited mandate funds.

Contents:

Highlights

Company Description

Market Position and Competition

Financial Performance

Management Guidance for 2024

Challenges and Opportunities

Price Action

Nerds Only Section: Stock Price Target & Valuation Considerations

Disclaimer

Company Description

Nubank is one of the largest neobanks in the world and offers customers a full range of banking services (debit cards, credit cards, insurance, mobile payment solutions, etc.) all-in-one convenient applications. In addition, the company provides access to buying cryptocurrencies through its NuCrypto platform and access to the stock market through the NuInvest application. The company operates in three markets: Brazil, Mexico, and Colombia.

Revenue Streams

Nubank generates revenue primarily through three main streams: interest income from its credit card and lending portfolios, fee and commission income, and interchange fees.

Source: Official Website

Market Position and Competition

The Rise of Neobanks in Latin America: The financial ecosystem of Latin America is witnessing a paradigm shift with the advent of neobanks. These digital-first financial institutions are revolutionizing the way banking services are delivered, especially to the underbanked and unbanked populations—a segment that has been largely overlooked by traditional banks.

Mobile Penetration and Financial Inclusion: Latin America has experienced a surge in smartphone adoption, transforming the way people access various services, including banking. This mobile penetration is a key driver in the success of neobanks.

Cost-Effective Banking: Neobanks operate with lower overhead costs compared to traditional banks, allowing them to offer more cost-effective services. This is particularly beneficial for low-income individuals who are sensitive to high banking fees.

Market Potential: With close to 100 million customers in Latin America, NuBank only owns less than 5% of the financial services revenue on the continent. This indicates a vast untapped market potential for the company to explore.

Financial Performance

In the fourth quarter of 2023, Nu acquired 4.8 million new customers, marking a y/y growth of 19.3 million, culminating in a total of 93.9 million customers globally by December 31, 2023. This demonstrates Nu's status as one of the largest and most rapidly expanding digital financial platforms globally, and it ranks as the fifth-largest financial institution in Latin America based on customer count. In Brazil, Nu's customer base reached 87.8 million by December 31, 2023, constituting 53% of the country’s adult population. According to data from the Brazilian Central Bank, Nu stands as the fourth-largest financial institution in Brazil in terms of customer base.

Nu's revenue for the quarter grew to $2.4 billion, marking yet another new record, representing a 66% increase compared to the fourth quarter of 2022, the total revenue for the 2023 FY grew to $8.3 billion, representing a 68% y/y. This demonstrates the company's unique ability to consistently expand its customer base, accelerating revenue growth and profitability.

Nu continued to increase profitability and reported a net profit of $360.9 million for Q42023, with an annual return on equity of 19.5%. For the 2023 fiscal year, net profit amounted to $1.0 billion compared to a net loss of $9.1 million the year before.

Total portfolio (credit card and personal loans) showed growth of 61% y/y and represents $18.2 billion by the end of the financial year and Q4, deposits showed 50% y/y growth with $23.7 billion in deposits.

Nu's array of products continues to expand, with credit cards, NuAccounts, and personal loans attracting approximately 41 million, 69 million, and over 7 million active customers, respectively. Presently, there are over 1 million active insurance policies and more than 15 million active investment customers.

Management Guidance for 2024

In 2024 guidance company awaits EPS to be in a range of $0.75 to $1.15 or $0.95 to $1.35 non-GAAP, revenue guidance is $1.73 to $1.87 billion, with an approximate 1% foreign currency headwind. For the 1Q, projected revenue ranges from $400 to $435 million, and EPS of $(0.07) to $0.03 or $0.00 to $0.10 excluding restructuring charges.

“We are building the largest consumer platform in Latin America, with strong earnings-generating capabilities, having delivered over $8 billion in revenues and $1 billion in net profit in 2023. As we work towards surpassing the 100 million customers milestone in 2024, we are investing heavily in new growth avenues to keep transforming potential into profit”

“I would like to outline our priorities for 2024 as well as how we believe we should be graded by the market against these objectives. Our first priority is to scale Mexico… Our second priority is to ramp up secured lending in Brazil…Priority number three is to continue to move into the high-income segment in Brazil. Success in 2024 entails launching several new products and features to our customers that will continue to increase our value proposition while using technology to increase even more our operating leverage.”

Challenges and Opportunities

Headwinds and Risks

Operating in multiple countries introduces regulatory complexities that could pose challenges for NuBank's expansion plans. Compliance with local regulations and obtaining necessary licenses may slow down the pace of growth in new markets.

The company faces significant competition from LatAm neo-banks (Lulo, Pibank, Uala, Stori, and FINSUS, all private companies). In addition, European competitors Wise or Revolut have recently entered the Brazilian markets. All these companies could take away market share, which would slow down the growth rate.

The Non-Performing Loan (NPL) ratios are in line with expectations, with 15-90 days NPL at 4.1% and 90+ days NPL stable at 6.1%. However, the expansion in newer cohorts' risk profiles could affect expected losses.

Fluctuations in market interest rates could affect the cost of borrowings and financings, particularly from the expansion of operations in markets like Mexico and Colombia. Additionally, changes in interbank rates, such as those experienced in Mexico, can impact the cost of retail deposits and, consequently, the net interest income.

Tailwinds

The introduction of new products such as secured personal loans and payroll loans presents opportunities for NuBank to cater to a wider range of customer needs and increase its market share.

NuBank outlined its intention to double down on investments in new products and features, particularly in Mexico and Colombia. The company sees these markets as pivotal for its growth strategy in 2024.

Nubank's strategic investments in high-income segments and innovative financial products position the company for long-term growth and profitability. By catering to the evolving needs of customers, Nubank aims to enhance customer loyalty and drive deeper engagement with its platform.

Average monthly revenue per active customer (ARPAC) rose to $10.6 in 4Q23, up 23% year-over-year, with older groups already at $27. The average monthly cost of service per active customer was virtually unchanged and below the dollar level of $0.9, which combined with steady ARPAC expansion quarter over quarter demonstrates the strong operating leverage of Nu's business model.

The company has created an artificial intelligence-based model that generates data on millions of individual consumers and SMEs across Latin America, providing unique insights into customer behavior. Using the data collected, the company was able to cross-sell effectively. The bottom line is that in 4Q2023, the average customer uses 3.5 products from the start, while in 2017 it took several years for a customer to start using the same amount of product.

Source: Official Website

Price Action

Nubank has outperformed the Nasdaq Composite Index by 3 times its returns over the past year.

Source: Yahoo Finance

Nerds Only Section

Stock Price Target Estimate

This part of our research is more about art than science. In general, valuation does not always align with the real pricing in the markets and is one of the most arguable topics. So, in this attempt, we try to evaluate the stock price range for a 1-year horizon based on historical P/E and P/S multiples, given that the PEG Ratio for growth companies is moving toward ~1.

Doing this and taking into consideration the leading nature of markets, we expect the stock’s price to be around $18 by the end of the year, with an upside to the current price of ~50-60%.

Valuation Considerations

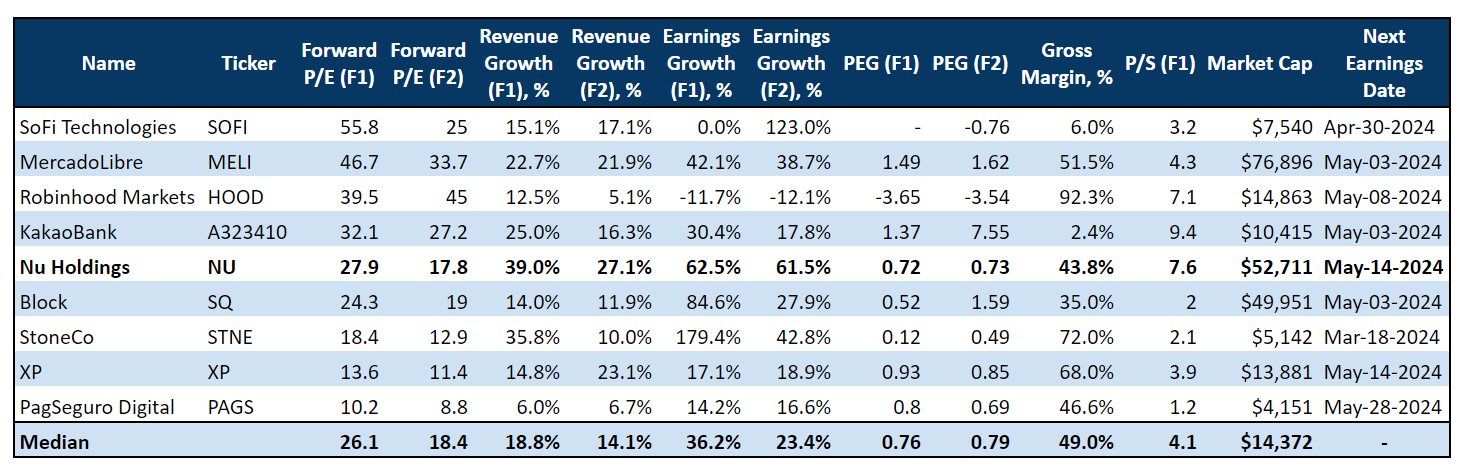

Nubank outperforms in forecasted revenue and earnings growth but is valued at a discount compared to selected peers. We see this as room for potential upward revision.

Disclaimer

Co-Authors: Fedor Katkov, Katerina Kiseleva

The team does not guarantee the accuracy or completeness of the information provided in this newsletter. All statements reflect personal opinions based on our financial and business analysis. Any estimates, forecasts, or forward-looking statements are subject to inherent uncertainties and should be viewed as indicative only. No statement herein constitutes an offer or solicitation to buy or sell any financial instruments mentioned.

The content of our newsletter is intended for general information purposes only and does not constitute trading or investment advice. We do not offer personalized investment advice tailored to the specific needs of any recipient. The information provided should not be construed as specific advice on the merits of any investment decision. Securities trading involves significant risk, including the potential loss of capital and other losses. Investors are advised to conduct their own independent research and consult with a registered investment advisor or financial advisor before making any investment decisions.

Neither the team nor any of its affiliates shall be liable for any direct or indirect losses arising from the use of the information contained herein. Unauthorized copying, distribution, or reproduction of this newsletter or its contents is strictly prohibited.

By subscribing to or reading our newsletter, or engaging with any associated social media accounts, you agree unconditionally to accept and be bound by these terms and conditions.