Constellation Stock #4: Casey's General Stores (CASY) - Growth Story

In the face of inflationary pressures that have tested the resilience of businesses across the globe, this company emerges not just unscathed but as a clear victor.

Intro

Casey's has adeptly turned challenges into opportunities, reinforcing its market position and demonstrating an enviable capacity to adapt and flourish even in turbulent times. This remarkable achievement is rooted in the company's strategic focus on thriving within the most prosperous states, catering primarily to the needs of the middle class, and skillfully acquiring weaker players in the market. In the context of diminishing inflationary pressures, Casey's General Stores is poised to continue its expansion, potentially solidifying an even stronger market position.

Company Overview

Casey's General Stores, Inc., established in 1959 and headquartered in Ankeny, Iowa, stands as a leading operator of over 2,500 convenience stores across the Midwestern United States. Known for its self-service gasoline, a wide range of grocery items, and signature prepared foods such as pizza and sandwiches, Casey's is recognized as the third-largest convenience store chain, the fourth in liquor licenses among U.S. retailers, and the fifth-largest pizza chain in the nation. Casey's uniquely integrates gas stations with its retail outlets, creating a seamless ecosystem that encourages customers to make additional in-store purchases. This model not only enhances customer convenience but also drives ancillary sales. The company's business model is distinguished by its substantial real estate ownership, following a strategy similar to McDonald's, which emphasizes acquiring land and constructing own stores and facilities. This approach has facilitated significant expansion, including the acquisition of 418 stores in recent years—259 of which were added in the past three years alone. Casey targets areas with average family net income while avoiding the poorest and wealthiest states. By filling the gap left by smaller, local chains that struggle with inflation and rising costs, Casey's acquired almost 100 smaller-size stores last year, demonstrating its commitment to dominating niche markets and driving growth within its operational footprint.

Last Close Price: $316.59

Shares out: 37.02M

MCap: ~ $11.44 B

Next Earnings Date: June 4, 2024

Short Interest: 1.85%

Div Yield: 0.56%

Buyback budget: $30.12M

Sector: Consumer Staples

Industry: Distribution and Retail

Revenue Streams

Casey's General Stores generates revenue through a diverse range of operating activities, encompassing the sale of products and services across several key categories:

Gas Stations: Each store is complemented by a fuel operation, offering a seamless campaign integration with the gas station for enhanced customer convenience.

Grocery: Casey's offers a selection of everyday products under its own brand, including milk, eggs, and frozen foods, with approximately 300 private-label products available to customers.

Pizza & Fresh Food: Renowned for its own pizza brand, Casey's provides a variety of fresh food options that cater to customer preferences for quick and quality meals.

Household Essentials: The stores also carry around 120 SKUs of household necessities, such as soaps and cleansers, uniquely branded under Casey's, ensuring customers have access to essential items.

Card Services: Casey's offers branded financial products like Casey's Visa Signature Card and Casey's Business Mastercard, which afford customers advantages and cashback on purchases within brand stores.

Gift Cards: Additionally, Casey's sells gift cards, allowing customers to share the convenience and quality of Casey's brand products in brand shops.

Recent Company News

Mar-4 2024: Casey’s launches all-new sandwich line-up.

Feb-9 2024: Casey’s Hires First-Ever Chief Pizza & Beer Officer.

Dec-1 2023: Casey’s acquires 11 EZ GO locations from Love’s. The deal follows the convenience retailer’s recent M&A-fueled move into Texas and pushes it closer to its goal of 350 new stores by 2026.

QUANTS

Financial Outlook

On March 11th the company released Q3 2024 FY results which beat the estimates but were not that great relative to the previous year:

Diluted EPS of $2.33, down 13% y/y

Net income was $87 million, down 13% y/y

EBITDA was $218 million, down 2% y/y

Inside same-store sales increased 4.1% y/y

Operating expenses for the Q3 were almost the same as the year-ago, increased 9.35%.

Furthermore, the company's net income for the nine months showcased a growth of 6% y/y, with both diluted and basic EPS demonstrating growth. The company's current liabilities for Q3 have remained relatively stable when compared to 2023, maintaining a current ratio of 1.1x for the third quarter and 0.9x for the last twelve months (LTM).

In terms of shareholder returns, Casey's dividend yield stands at 0.56%, with forward dividend per share growth at 12%, significantly surpassing the industry average of 4%. The company adheres to a quarterly dividend payment schedule, with the next distribution set for May 15th, amounting to $0.430 per share. This performance and strategic financial management underscore Casey's resilience and its commitment to delivering value to its shareholders.

Source: Casey’s Investor Presentation

Q32024FY Earnings Key Management Comments

“Our results were solid, especially inside the store where we continue to grow sales and expand margin. This was accomplished during a quarter of heavy integration of acquired stores across our footprint.”

“We have had an excellent unit growth year so far, especially with M&A. During the third quarter, we closed on a transaction to enter our 17th state in Texas. And through the end of the quarter, we have built or acquired over 125 stores.”

“…we've done so many of these now, these, I'll call them, under 100 store size acquisitions.”

“…we like to strike the balance between organic growth and M&A. We don't ever want to put all our eggs in either one of those baskets because situations can change. And so what we're seeing right now is that the M&A environment is pretty attractive. The cost of construction has gone up.”

Tailwinds

Casey's demonstrated resilience with its business model and team, navigating challenges like less favorable fuel cost environments and adverse weather, still delivering solid performance.

Notably strong same-store sales in prepared food and inside sales, driven by product innovations and effective pricing strategies, underline Casey's ability to grow its high-margin segments.

The company's strategic acquisitions, including entering a new state (Texas) and adding over 125 stores, highlight Casey's commitment to growth. This approach enhances its market footprint and drives further scale, supported by efficient integration processes that have matured over time.

Headwinds

The ongoing volatility in fuel sales, attributed to fluctuating wholesale petroleum costs, remains a significant headwind. Despite managing a balanced approach between volume growth and margin, the sticky-inflation factor could affect profitability.

Casey's heavy concentration in the Midwest exposes it to region-specific economic downturns and weather-related disruptions, which could impact its overall performance compared to more geographically diversified peers.

Industry Comps Analysis

Source: Stockpickingsouk

Casey's diverse range of activities makes direct comparisons with pure-play peers challenging, which is why our analysis includes a variety of company profiles among its comparables.

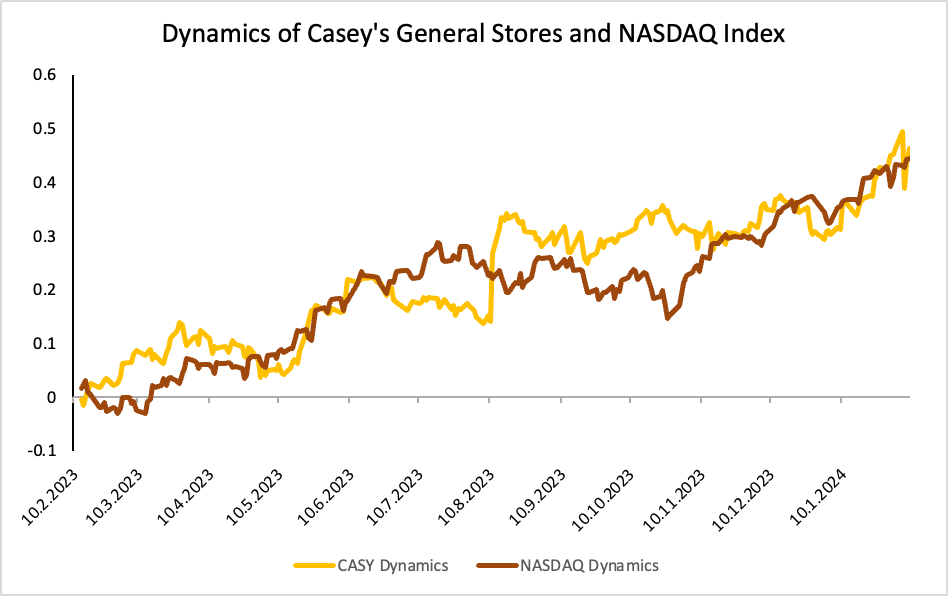

Price Action and Benchmarking

Source: Yahoo Finance

Key Risks

The retail sector's inherent high turnover rates necessitate continuous investment in employee retention and training. Casey's is compelled to enhance its workforce management strategies to uphold service quality and operational efficacy, especially in light of legal complexities like those surrounding the FLSA classification of employees.

Intense competitive landscape that Casey's operates in. The convenience store market's competitiveness demands that Casey's persistently innovates and differentiates its product and service offerings. The emergence of larger chains and technologically advanced new entrants poses a constant challenge to Casey's market position.

The regulatory landscape, particularly concerning the sale of tobacco and nicotine products, poses ongoing risks. Still, Casey’s now reducing the share of tobacco products. Potential changes in tax legislation or regulatory frameworks could unfavorably impact Casey's financial outcomes, alongside societal shifts against tobacco consumption.

Stock Price Target Estimate

Source: Stockpickingsouk

We see the company’s stock target price around 330-350 for this year. Not much upside but taking into consideration the deal’s defensive nature it could be potentially a good pick to consider.

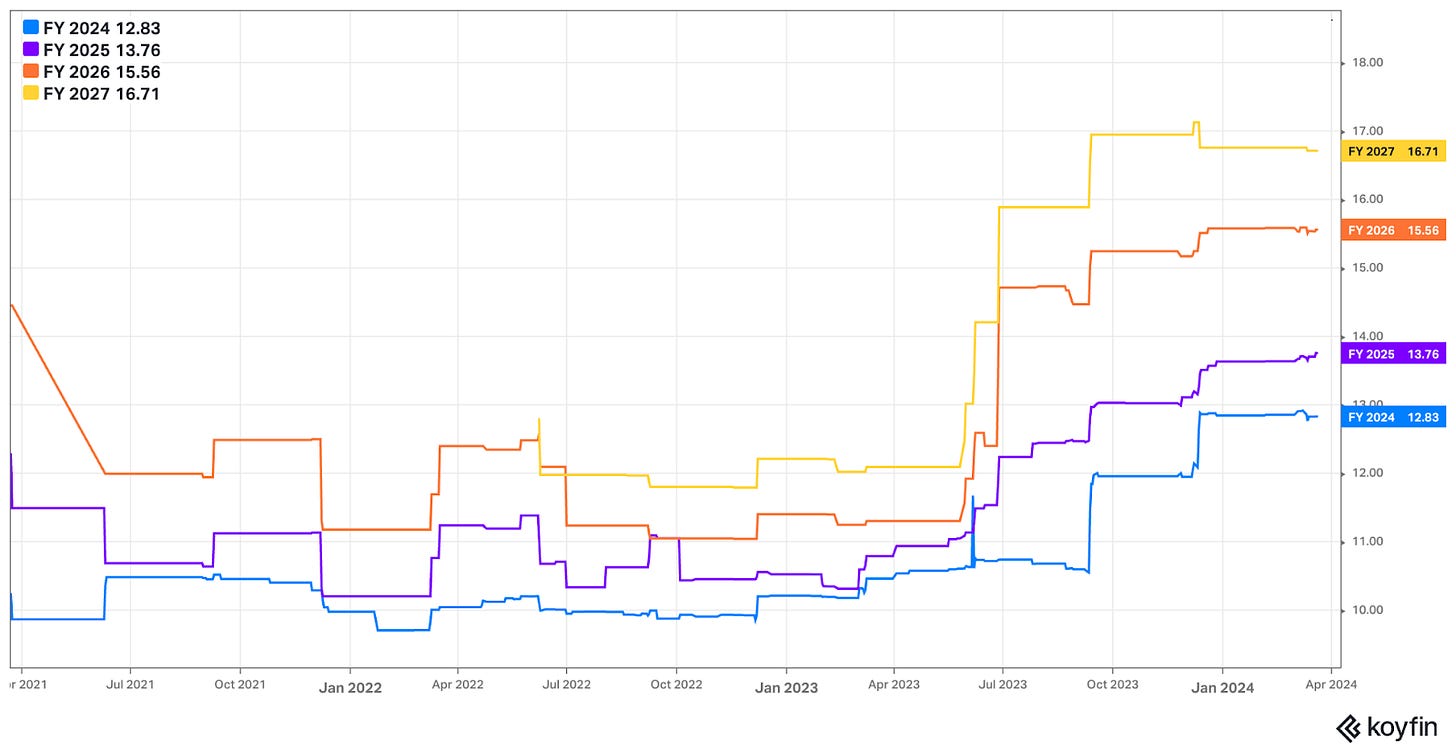

Earnings and Sales Revisions by Analysts

Disclaimer

Co-Authors: Katerina Kiseleva

Please note that this article represents just one piece of a comprehensive equity research report we prepare on every potential investment idea we consider adding to our portfolio. This content is for informational or educational purposes only and is not to be taken as personalized financial advice. Happy investing!

Remember, all investments carry risk. It's important to practice diligent risk management and conduct your research before making any investment decisions. This content is not intended to provide investment advice.