Animal spirits are back in the markets

How I analyze macro and company data to manage my L/S stock options strategy with a 100%+ annual return target

Market View

Fears about elevated inflation evaporated with the latest data prints.

That suggests last month’s PPI spike was more of a one-time event than the start of a new trend.

Tariffs also didn’t affect the inflation data, for a few possible reasons:

Companies may want to pass higher import tariffs on to consumers, but demand isn’t strong enough to absorb those price hikes.

Many goods sold now were imported earlier at lower prices, so the newer, higher-priced shipments haven’t yet hit the shelves.

Since goods make up only about 30–35% of consumer spending (PCE) and services account for 65–70%, tariff hikes on goods mainly raise goods prices first. But because goods are a smaller share, the immediate effect on overall inflation is limited.

I see “animal spirits” are returning to the market, and we may see bulls pulling stocks higher through year-end.

Of course, nothing is guaranteed in markets, and all eyes now turn to the reaction to Retail Sales and the Fed’s Economic Projections data next week.

Corporate Earnings

Alongside the macro picture, let’s take a look at corporate earnings.

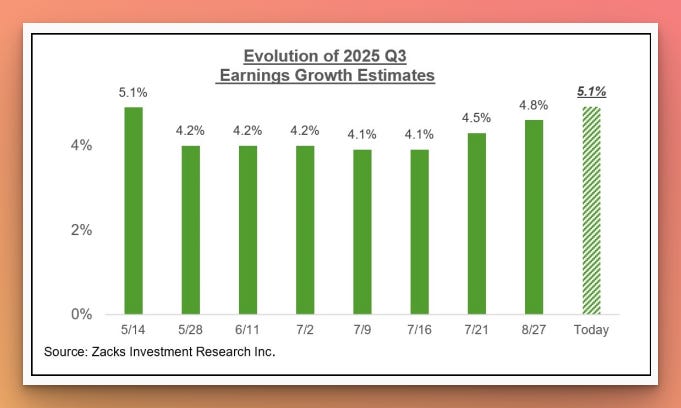

The overall revisions trend remains positive, with estimates for the back half of the year steadily moving higher.

That’s constructive for Q3 earnings season, but it also raises the risk that actual results could fall short. Put differently, expectations may now be running ahead of reality.

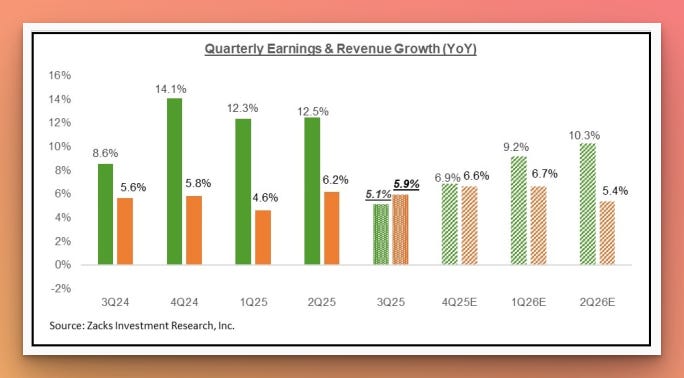

The chart below shows Q3 2025 expectations in the context of results from the prior four quarters and what’s currently projected for the next three.