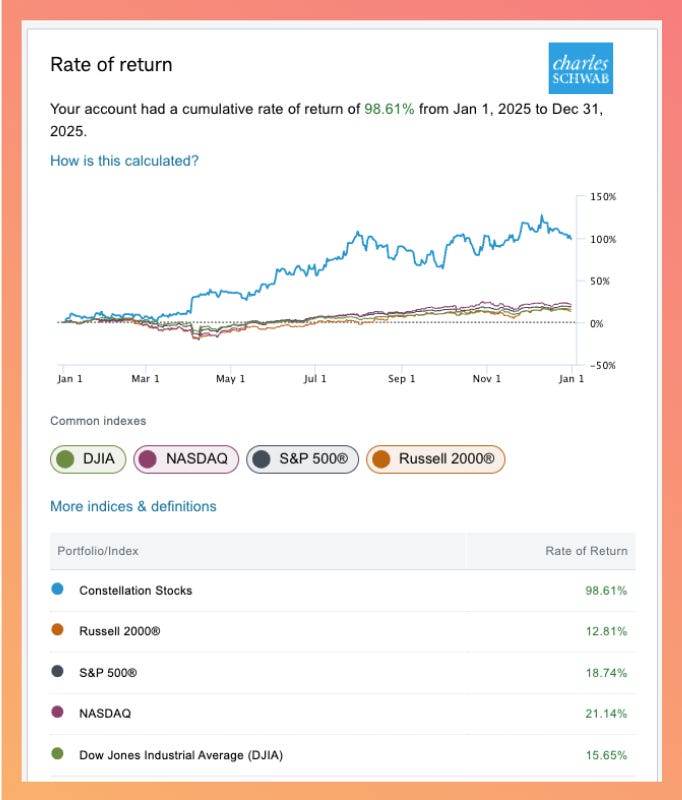

2025 Performance Recap: My Strategy Gained $173,798 (+98%) and Outperformed S&P by 4X

Constellation Stocks strategy return reached +98.61% vs S&P 18.74%

My strategy outperformed the market by 4X in 2025

In 2025, the Constellation Stocks strategy performance went up 98.61% compared to the 18.74% S&P 500 return.

There is no magic behind these numbers. It is simply consistent work:

finding strong companies for the long side and weak companies for the short side

spotting valuation catalysts that can play out within 1 to 3 months

building high-ROI option structures for each idea

staying disciplined with risk management

In 2025, the strategy proved it can perform well in both market sell-offs and rebounds.

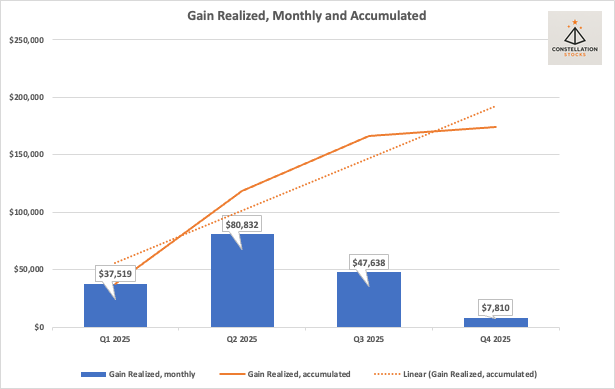

During the tariff-related sell-off in Q1, the strategy returned 19.09%, or $37,519.

In Q2, as markets rebounded and AI hype accelerated, it delivered another 41.14%, or $80,832.

Together, these two high-volatility periods generated about 60% of the total annual return, showing where the strategy performs best.

Q3 was also strong, adding 24.24% to capital, or $47,638.

Q4, however, was quieter, with a return of 3.97%. This highlighted areas where the strategy can be fine-tuned going forward, which I discuss later.

The chart below shows both the quarterly net gains and how total returns accumulated over the year.

The January account size doubling opportunity

January 2026 is shaping up to be a prime window for stock traders.

After a quiet December, implied volatility is expanding.

And earnings season, the Super Bowl for traders, is officially here.

Get ready and become a better trader, considering the paid subscription, which gets you:

Get feedback on your trades

Weekly high-conviction setups

Access to my options portfolio (where I invest my own capital)

Done-for-you research (to save you 20 hours a week researching)

The paid subscription costs only $9.99/month.

Imagine earning a couple of $1,000 a month with just a $9.99 investment!

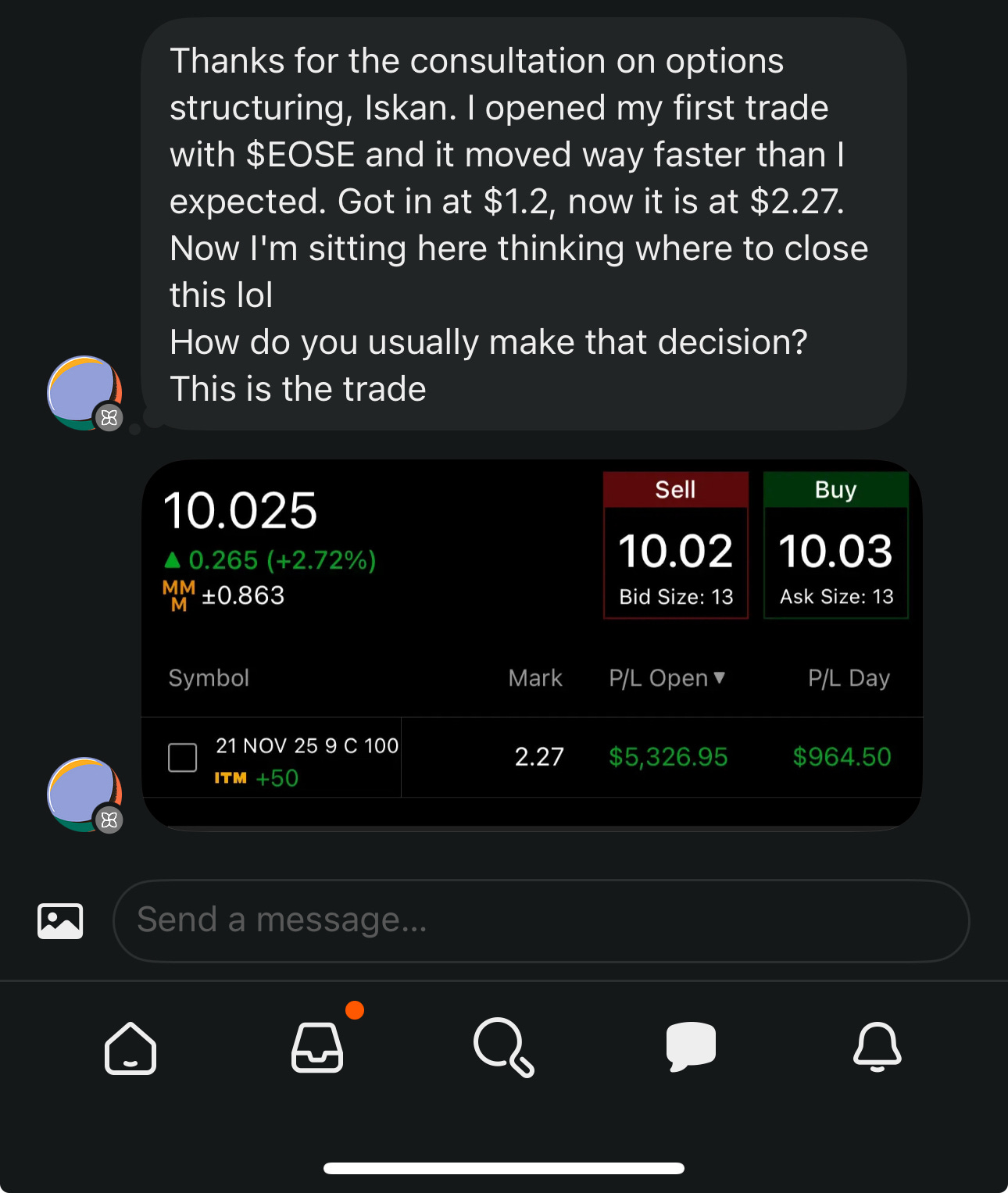

Here is how the Constellation Stocks members have done so far

Real results from stock traders improving their craft.

Here’s a student who made $5.3k on a trade. He came from an IT background.

He achieved this result one month after becoming a founding subscriber of the newsletter and taking two 1:1 calls

December 2025 turned out to be a low-volatility, sideways market, and several ideas I was positioned in did not move as strongly as expected.

At the same time, for tax optimization reasons, I chose to close some loss-generating positions before year-end, earlier than their January and February 2026 expirations.

In 2026, my focus is on fine-tuning the strategy to perform better in low-volatility, sideways market regimes. This includes cutting underperforming ideas earlier and being more willing to re-enter later, rather than holding positions and letting option value erode due to time decay.

Let’s now take a look at some trade statistics from 2025.

Top 5 winning trades:

CMG +$37,001

AAPL +$36,413

USAR +$35,900

BE +35,626

CRDO +$26,998

Top 5 losing trades:

BIRK -$19,306

TSLA -$15,000

BBY -$12,072

MMYT -$11,280

LOW -$11,138

Total number of tickers traded in 2025: 94

Number of winning trades: 46

Gains from winning trades: +$445,318

Number of losing trades: 48

Losses from losing trades: -$271,520

Total return: $173,798

This is the beauty of options trading combined with proper risk management. Even when losing trades outnumber winners, the strategy can remain profitable as long as winners are allowed to grow and losses are controlled.

Why Long / Short Portfolio

At their core, options allow you to capture non-linear returns from price moves and changes in volatility.

The trap appears when you run only one-sided exposure. If you hold a basket of long calls across names and the market turns, premiums can decay to zero.

The solution is balance. Combining longs and shorts, and carefully selecting underlyings and structures, lets you build a portfolio where winners outweigh losers and the process compounds over time.

To help you become a market-agnostic trader:

choose a strategy that can make money when the market goes up and when it goes down

learn how to spot catalysts that can change a stock’s value

use tools or structures that limit your risk

accept that you may have three losing trades for every one big winner

pay attention to major macro events

Hope this was helpful.

And if it was, hit reply & let me know.

Talk soon,

Iskan

About the author

Iskan is a professional trader and investor who managed a private equity fund with $120 million in Assets Under Management. He has invested over $80,000 in his trading education and spends more than 50 hours per week researching stocks.

Disclaimer

As a reader of Constellation Stocks, you agree to our disclaimer. You can read the full disclaimer here.