2 More Cuts, Strong Earnings, and New Stock Ideas for the Week

A calmer inflation print, a stronger earnings season, and my latest portfolio updates. Plus, insights from Fordham’s AI in Value Investing event.

Macro

The latest inflation data came in lower than expected, keeping the door open for two additional Fed rate cuts before year-end.

The next major event is the press conference with the Fed Chair on October 29, where we could finally hear an update on the labor market, since the September data hasn’t been released yet due to the ongoing government shutdown.

According to Bloomberg, weekly jobless claims point to a continued cooling trend in the labor market.

Corporate Earnings

We are in the middle of the earnings season, and results so far have been solid, supporting the market’s bullish case.

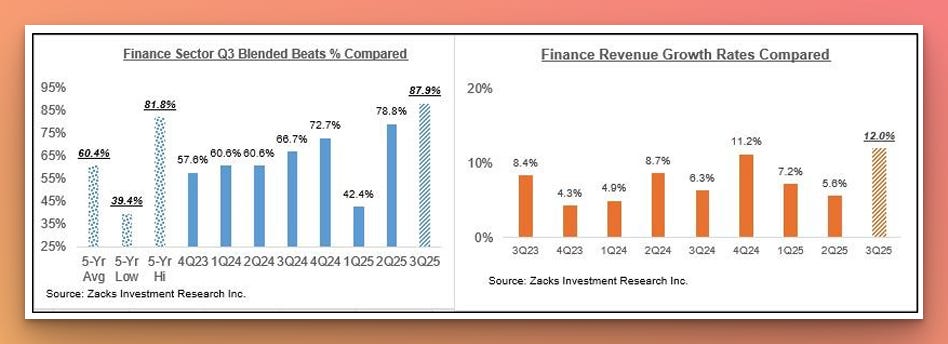

For the 99 S&P 500 members that reported Q3 results as of October 22, total earnings increased by 13.7% year over year on 8.2% higher revenues. EPS estimates were beaten by 86.9% of companies, and 81.8% beat revenue estimates. In total, 75.8% percent beat both EPS and revenue expectations.

For Q3 2025 overall, earnings growth is expected at 7.3% on 6.7% revenue gains. These estimates have been steadily increasing since the start of the quarter.

The chart below shows expectations for 2025 Q3 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

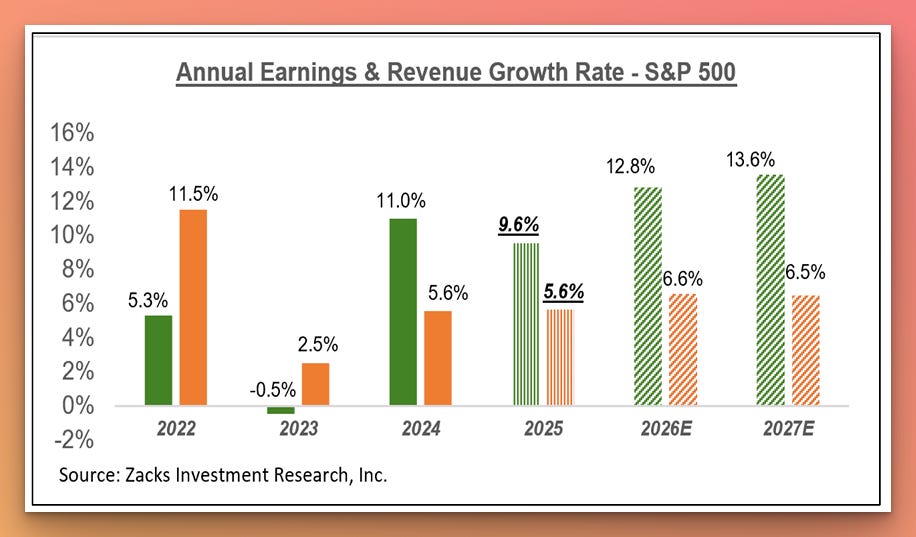

The chart below shows the overall earnings picture for the S&P 500 index on an annual basis.

There is still a high discrepancy in the sectors’ quarterly earnings performance. As per Zacks’ sectors structure, 9 out of 16 sectors are expected to deliver less earnings relative to the year-earlier period. These include Cons. Staples (-4.8%), Cons. Discretionary (-4.7%), Medical (-4.3%), Autos (-25.3%), Industrial Products (-1.1%), Construction (-13.8%), Transportation (-5.9%), and Energy (-6.4%).

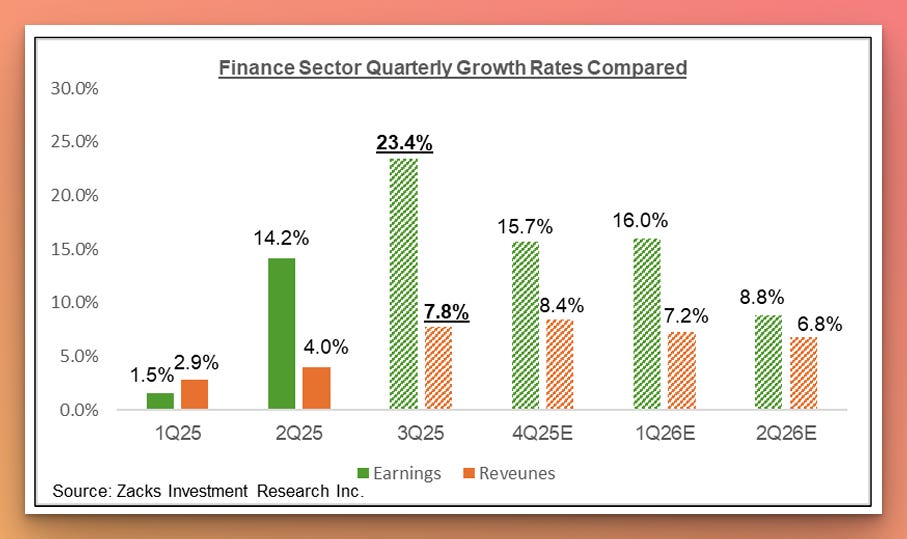

On the positive side, 7 of the 16 Zacks sectors are projected to post positive growth, including Basic Materials (+2.0%), Retail (+5.2%), Technology (+11.5%), Aerospace (+248.6%), Finance (+23.4%), and Business Services (+4.7%).

Finance sector recovery growth is a backbone for a market bull case.

As of October 22, 2025, we have Q3 results from 54.5% of the sector’s total market capitalization in the S&P 500 index. Total earnings for these Finance sector companies are up +23.0% from the same period last year on +12.0% higher revenues, with 97.0% beating EPS estimates and 87.9% beating revenue estimates.

Next week, with more than 800 companies reporting results, including 5 of the Magnificent 7 members and almost a third of S&P 500 members.

If there are no surprises related to the truce negotiations with China, I do not expect any major shocks from earnings. That makes the Fed conference on Wednesday the main event to watch.

Portfolio Update

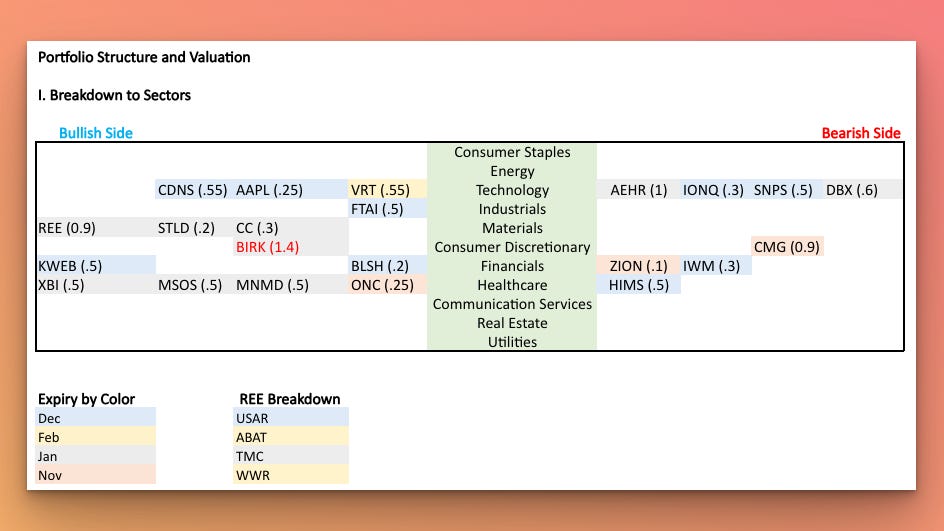

I will be entering the next week with the following L/S book structure:

Instructions on how to read the image:

👉 Cell colors distinguish the month of the option contract expiration from November to February 2026.

👉 Numbers in brackets = portion of a full-size position, depending on risks and conviction.

📌 I share position updates for paid subscribers in a special data sheet live.

During the week, I added 6 newly researched ideas based on recent earnings reports to a shared Stock Ideas Pipeline: 3M Company MMM 0.00%↑, Vertiv Holdings VRT 0.00%↑, RTX Corporation RTX 0.00%↑, Steel Dynamics STLD 0.00%↑, GE Aerospace GE 0.00%↑, and Cleveland-Cliffs CLF 0.00%↑.

The following companies are on my watchlist as potential candidates for new positions, depending on how catalysts develop next week.

Piece of Knowledge

A few weeks ago, I had the pleasure of joining an outstanding event organized by Fordham University Gabelli School of Business. The topic couldn’t be more relevant - AI in Value Investing.

The event featured three panel discussions. The first one, “Generative AI: Competitive Advantage or Competitive Necessity”, was presented by Paul Johnson, the school’s Executive Director.

It was a great introduction to the broader AI landscape, but what I really liked was how Paul broke down the math behind hyperscalers’ earnings and how much they’d have to grow to justify the huge CAPEX being poured into AI infrastructure.

The second panel, “AI Tools Powering the Next Generation of Investment Research”, moderated by Brett Caughran from Fundamental Edge, was full of insights for anyone working with data and equity research.

The speakers, Tarun (Endex AI), Kris (Hudson Labs), and David (Portrait Analytics), shared an interesting perspective: access to data is becoming less monopolized by giants like SPGI 0.00%↑, FDS 0.00%↑, and MORN 0.00%↑. The AI moat is shrinking, and that’s a signal for investors to revalue those businesses. Just look at FDS 0.00%↑ valuation dynamics.

Personally, I took away a lot of ideas for optimizing the stock analysis workflow in my own strategy. Many PMs already have AI tools or even “AI analysts” working for them 24/7 - and that’s where the real advantage in data processing is moving.

The final panel, “Investing with Generative AI”, brought the discussion from theory to practice. Real portfolio managers shared how they integrate AI into their investment process, particularly in analyzing software companies that are either benefiting from or being disrupted by AI - think CRM 0.00%↑.

Panelists included Brett Caughran (Fundamental Edge), Andrew Freedman (Hedgeye), and John Belton (Gabelli Funds).

Big thanks to Gabelli School of Business and Fundamental Edge for putting this together. It was one of the most thought-provoking events I’ve attended this year.

Here’s a photo from the school’s trading floor:

All the best to everyone, have a great start to the week tomorrow!